Rising Incidence of Plant Diseases

The rising incidence of plant diseases poses a significant challenge to agricultural productivity, thereby driving the biofungicides market. With climate change and changing weather patterns, the prevalence of fungal infections has increased, leading to substantial crop losses. Farmers are increasingly turning to biofungicides as effective solutions to combat these diseases. The biofungicides market is witnessing a surge in demand as these products offer targeted action against specific pathogens while being less harmful to beneficial organisms. The market is expected to reach a valuation of over $1 billion by 2027, indicating a robust growth trajectory. This trend underscores the necessity for innovative and effective disease management strategies in agriculture.

Supportive Government Policies and Incentives

Supportive government policies and incentives play a crucial role in fostering the growth of the biofungicides market. Various federal and state initiatives aim to promote sustainable agricultural practices, including the use of bio-based products. Programs that provide financial assistance or tax incentives for farmers adopting biofungicides are becoming more prevalent. This regulatory support encourages farmers to transition from traditional chemical fungicides to biofungicides, thereby enhancing market growth. The biofungicides market is likely to see increased investment and innovation as a result of these supportive measures, which aim to improve agricultural sustainability and food security.

Consumer Preference for Chemical-Free Products

Consumer preference for chemical-free agricultural products is a driving force in the biofungicides market. As health-conscious consumers become more aware of the potential risks associated with chemical residues in food, there is a marked shift towards organic and naturally produced goods. This trend is reflected in the increasing sales of organic produce, which have seen a growth rate of approximately 10% annually in the US. The biofungicides market is poised to capitalize on this shift, as biofungicides align with consumer demands for safer food options. Retailers are increasingly stocking bio-based products, further enhancing their visibility and availability in the market.

Increasing Awareness of Sustainable Agriculture

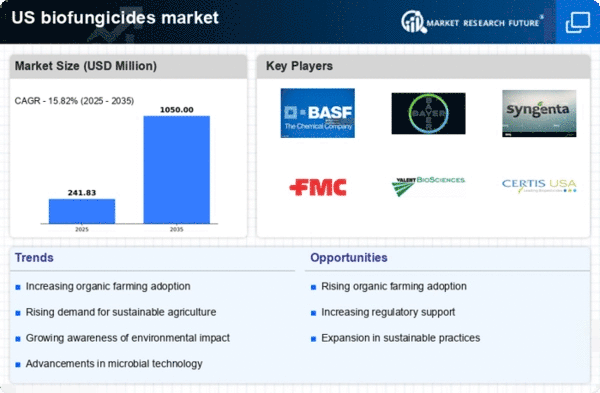

The growing awareness of sustainable agriculture practices among farmers and consumers is a key driver for the biofungicides market. As environmental concerns rise, there is a shift towards eco-friendly farming methods. This trend is reflected in the increasing adoption of biofungicides, which are perceived as safer alternatives to chemical fungicides. In the US, the market for biofungicides is projected to grow at a CAGR of approximately 12% from 2025 to 2030. This growth is fueled by the demand for sustainable solutions that minimize environmental impact while maintaining crop yields. The biofungicides market is likely to benefit from educational initiatives aimed at promoting the advantages of bio-based products, further enhancing their acceptance among agricultural stakeholders.

Technological Innovations in Biofungicide Development

Technological innovations in biofungicide development are significantly influencing the biofungicides market. Advances in biotechnology and microbial research have led to the creation of more effective and targeted biofungicides. These innovations not only improve the efficacy of biofungicides but also expand their application range across various crops. The biofungicides market is experiencing a wave of new product launches, driven by research and development efforts aimed at enhancing product performance. As a result, the market is expected to witness a compound annual growth rate (CAGR) of around 11% over the next five years, reflecting the potential of technology to transform agricultural practices.