Rising Prevalence of Fibromyalgia

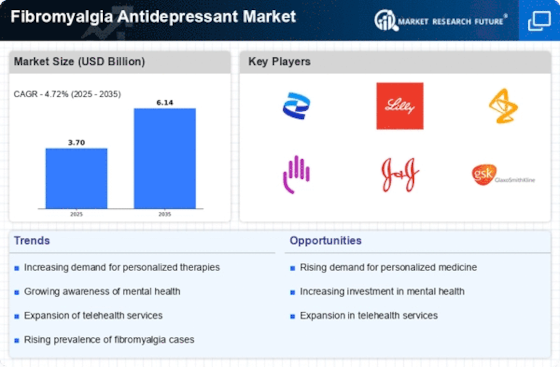

The increasing prevalence of fibromyalgia is a primary driver for the Fibromyalgia Antidepressant Market. Recent estimates suggest that fibromyalgia affects approximately 2-4% of the population, with a higher incidence in women. This growing patient population necessitates effective treatment options, particularly antidepressants that can alleviate both pain and associated mood disorders. As awareness of fibromyalgia expands, more individuals are seeking medical attention, thereby increasing the demand for antidepressants specifically tailored for this condition. The Fibromyalgia Antidepressant Market is likely to experience growth as healthcare providers recognize the need for targeted therapies that address the multifaceted nature of fibromyalgia.

Regulatory Support for New Treatments

Regulatory support for new treatments is a crucial driver for the Fibromyalgia Antidepressant Market. Regulatory agencies are increasingly facilitating the approval process for innovative antidepressants designed specifically for fibromyalgia. This support encourages pharmaceutical companies to invest in research and development, leading to a broader array of treatment options for patients. As new drugs receive approval and enter the market, the Fibromyalgia Antidepressant Market is likely to expand, providing patients with more effective therapies that address their unique needs.

Advancements in Pharmacological Research

Advancements in pharmacological research are significantly influencing the Fibromyalgia Antidepressant Market. Ongoing studies are exploring novel antidepressants that target specific neurotransmitter systems, potentially leading to more effective treatment options. For instance, medications that modulate serotonin and norepinephrine levels have shown promise in clinical trials, indicating a shift towards more personalized treatment approaches. The market is witnessing an influx of innovative drugs that may enhance patient outcomes and reduce side effects. As research continues to evolve, the Fibromyalgia Antidepressant Market is poised for expansion, driven by the introduction of new therapeutic agents that address the unique challenges of fibromyalgia.

Growing Awareness and Diagnosis of Fibromyalgia

The growing awareness and diagnosis of fibromyalgia are pivotal factors propelling the Fibromyalgia Antidepressant Market. Increased education among healthcare professionals and the public has led to more accurate diagnoses, allowing patients to receive appropriate treatment sooner. This heightened awareness is reflected in the rising number of prescriptions for antidepressants specifically indicated for fibromyalgia. As healthcare systems improve their diagnostic criteria and treatment protocols, the Fibromyalgia Antidepressant Market is likely to benefit from a surge in demand for effective antidepressant therapies that cater to this condition.

Integration of Mental Health in Pain Management

The integration of mental health considerations into pain management strategies is reshaping the Fibromyalgia Antidepressant Market. Recognizing the interplay between chronic pain and mental health, healthcare providers are increasingly prescribing antidepressants as part of a comprehensive treatment plan for fibromyalgia. This holistic approach not only addresses physical symptoms but also targets the psychological aspects of the condition, such as anxiety and depression. As more clinicians adopt this integrated model, the Fibromyalgia Antidepressant Market is expected to grow, reflecting a shift towards more comprehensive care that acknowledges the complexity of fibromyalgia.