Advancements in Medical Research

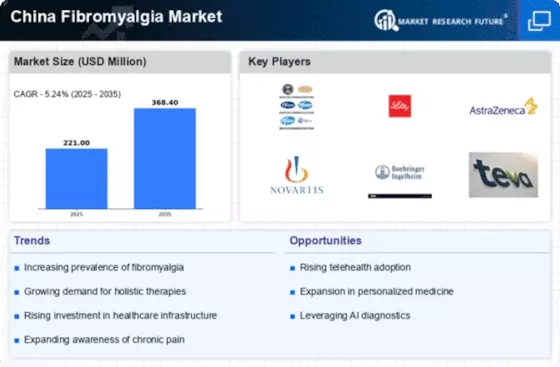

Ongoing advancements in medical research related to fibromyalgia are significantly influencing the China Fibromyalgia Market. Research institutions and universities in China are increasingly focusing on understanding the pathophysiology of fibromyalgia, which may lead to the development of novel treatment modalities. For instance, studies exploring the role of neuroinflammation and genetic predisposition are gaining traction. This research not only enhances the understanding of fibromyalgia but also paves the way for innovative therapies, including biologics and personalized medicine. As new treatments emerge, they are likely to capture the attention of healthcare providers and patients alike, thereby expanding the market. The synergy between research and clinical application is expected to drive growth in the China Fibromyalgia Market.

Enhanced Patient Support Systems

The establishment of enhanced patient support systems is a crucial driver for the China Fibromyalgia Market. Support networks, including online forums, local support groups, and educational resources, are becoming increasingly available for individuals with fibromyalgia. These systems provide patients with valuable information, emotional support, and a sense of community, which can significantly improve their quality of life. Furthermore, advocacy organizations are working to raise awareness about fibromyalgia, pushing for better recognition and treatment options within the healthcare system. As these support systems grow, they are likely to encourage more individuals to seek diagnosis and treatment, thereby expanding the patient base. This trend indicates a positive trajectory for the China Fibromyalgia Market, as increased patient engagement can lead to higher demand for therapies and services.

Rising Prevalence of Fibromyalgia

The increasing prevalence of fibromyalgia in China is a notable driver for the China Fibromyalgia Market. Recent estimates suggest that approximately 2-4% of the population may be affected by this condition, translating to millions of individuals. This growing patient base necessitates enhanced healthcare services and treatment options, thereby propelling market growth. As awareness of fibromyalgia expands, healthcare providers are more likely to recognize and diagnose the condition, leading to increased demand for therapies and support. Furthermore, the Chinese government has initiated various health policies aimed at improving chronic pain management, which could further stimulate the China Fibromyalgia Market. The combination of rising prevalence and supportive policies indicates a robust market potential.

Government Initiatives and Policies

Government initiatives and policies aimed at improving healthcare access and chronic pain management are pivotal for the China Fibromyalgia Market. The Chinese government has recognized the need for better management of chronic conditions, including fibromyalgia, and has implemented various health reforms. These reforms focus on enhancing healthcare infrastructure, increasing funding for pain management programs, and promoting awareness campaigns. Such initiatives are likely to improve diagnosis rates and treatment accessibility for fibromyalgia patients. Additionally, the integration of fibromyalgia management into national health strategies could lead to increased funding for research and development of new therapies. Consequently, these government actions are expected to bolster the China Fibromyalgia Market.

Growing Demand for Alternative Therapies

The growing demand for alternative therapies in China is emerging as a significant driver for the China Fibromyalgia Market. Many patients are seeking holistic and non-pharmacological approaches to manage their fibromyalgia symptoms, including acupuncture, herbal medicine, and mindfulness practices. This trend reflects a broader shift towards integrative healthcare, where patients prefer treatments that address both physical and emotional aspects of their condition. The increasing acceptance of alternative therapies among healthcare providers further supports this demand. As more patients turn to these options, the market for alternative treatments is likely to expand, creating new opportunities within the China Fibromyalgia Market. This diversification of treatment options may enhance patient satisfaction and improve overall health outcomes.