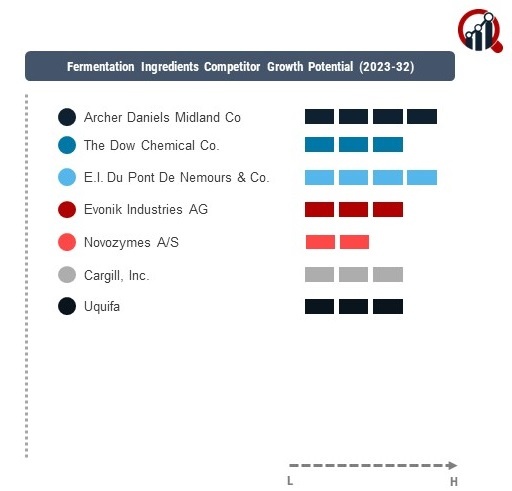

Top Industry Leaders in the Fermentation Ingredients Market

The fermentation ingredients market is a dynamic and competitive space that plays a pivotal role in various industries, including food and beverages, pharmaceuticals, and biofuels. The competitive landscape is shaped by key players employing diverse strategies to gain market share and stay ahead in the rapidly evolving market.

Some of the prominent players in the fermentation ingredients market include

-

Archer-Daniels-Midland Co.

-

The Dow Chemical Co

-

Cargill Incorporated

-

I. du Pont de Nemours & Co.

-

Evonik Industries AG

-

Novozymes A/S

-

Uquifa

Strategies Adopted:

adopted by these key players revolve around product innovation, strategic partnerships, and geographic expansion. Many companies are investing heavily in research and development to introduce new and advanced fermentation ingredients that cater to the growing demand for sustainable and natural products. Collaborations with other industry players, acquisition of complementary businesses, and strategic alliances are also common strategies to strengthen market positioning.

Market Share Analysis Factors:

Market share analysis is influenced by various factors, including product portfolio, distribution channels, pricing strategies, and brand reputation. Companies that invest in extensive research and development to create high-quality and cost-effective fermentation ingredients often capture a larger market share. Additionally, effective marketing and distribution strategies contribute significantly to market dominance.

New & Emerging Companies:

Several new and emerging companies are entering the fermentation ingredients market, intensifying competition. These companies bring fresh perspectives and innovative solutions, challenging established players. Some noteworthy entrants include BioSpring, Biomin, and Kerry Group. These companies leverage technology and sustainability trends to disrupt traditional markets and carve a niche for themselves.

The industry has witnessed a slew of developments and investments in recent times. Notable industry news includes Cargill's acquisition of Lallemand Bio-Ingredients, a move aimed at expanding its portfolio of fermentation-derived products. Similarly, DuPont's partnership with the Bio-PDO™ plant in Thailand demonstrates a strategic alliance to strengthen its position in the Asia-Pacific region.

Current investment trends indicate a strong focus on sustainability and environmental responsibility. Many companies are allocating significant resources to develop fermentation ingredients with a reduced environmental footprint. This aligns with the global shift towards eco-friendly practices and reflects the growing consumer preference for sustainable products.

Competitive Scenario:

The overall competitive scenario is marked by a balance between established players and new entrants. While key players maintain their dominance through brand recognition and extensive distribution networks, emerging companies leverage innovation and agility to challenge traditional market dynamics. This balance creates a healthy competitive environment, fostering innovation and driving industry growth.

Recent Development

The fermentation ingredients market witnessed several notable developments. DuPont introduced a novel fermentation ingredient with enhanced functionality for the food and beverage industry. This product launch was a strategic move to address the evolving demands of consumers and gain a competitive edge in the market. Additionally, Archer Daniels Midland Company announced a strategic partnership with a biotechnology firm to explore new avenues for fermentation-derived products, indicating a commitment to diversifying its product offerings.