Rising Demand for Animal Feed

The Feed Intermediate Chemicals Market is experiencing a notable increase in demand for animal feed, driven by the growing global population and the subsequent rise in meat consumption. As more consumers seek protein-rich diets, livestock production intensifies, necessitating higher quantities of feed. This trend is reflected in the projected growth of the animal feed market, which is expected to reach approximately USD 500 billion by 2026. Consequently, the demand for feed intermediate chemicals, which play a crucial role in enhancing feed quality and nutritional value, is likely to surge. The Feed Intermediate Chemicals Market must adapt to this increasing demand by innovating and optimizing production processes to ensure sustainability and efficiency.

Regulatory Support for Feed Quality

The Feed Intermediate Chemicals Market benefits from stringent regulations aimed at improving feed quality and safety. Governments across various regions are implementing policies that mandate the use of high-quality feed ingredients, which in turn drives the demand for feed intermediate chemicals. These regulations often focus on nutritional standards, safety protocols, and environmental sustainability, compelling manufacturers to invest in advanced chemical solutions. As a result, the market for feed intermediate chemicals is projected to grow, with an estimated CAGR of 5% over the next five years. This regulatory landscape not only enhances consumer confidence but also encourages innovation within the Feed Intermediate Chemicals Market, fostering the development of new products that meet evolving standards.

Technological Innovations in Production

Technological advancements are reshaping the Feed Intermediate Chemicals Market, leading to more efficient production methods and improved product quality. Innovations such as precision fermentation and biotechnology are enabling manufacturers to create feed additives that enhance animal health and growth rates. For instance, the integration of artificial intelligence in production processes allows for better monitoring and optimization of chemical formulations. This shift towards technology-driven solutions is expected to increase the market size significantly, with estimates suggesting a potential growth of 6% annually. As the Feed Intermediate Chemicals Market embraces these innovations, it is likely to see enhanced competitiveness and the ability to meet diverse consumer needs.

Increasing Focus on Sustainable Practices

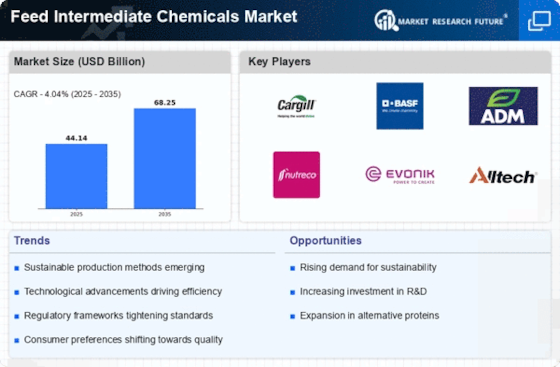

Sustainability is becoming a pivotal concern within the Feed Intermediate Chemicals Market, as stakeholders seek to minimize environmental impact. The demand for eco-friendly feed additives and chemicals is on the rise, driven by consumer awareness and regulatory pressures. Companies are increasingly adopting sustainable sourcing practices and developing biodegradable alternatives to traditional feed intermediates. This shift not only aligns with The Feed Intermediate Chemicals Market opportunities. The Feed Intermediate Chemicals Market is projected to witness a growth rate of approximately 4% as businesses invest in sustainable technologies and practices, thereby enhancing their market position and appeal to environmentally conscious consumers.

Global Trade Dynamics and Supply Chain Resilience

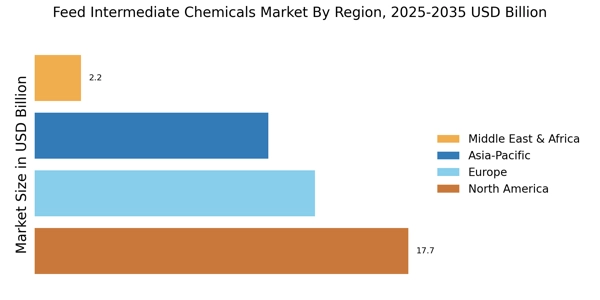

The Feed Intermediate Chemicals Market is influenced by global trade dynamics, which affect the availability and pricing of raw materials. Recent shifts in trade policies and supply chain disruptions have prompted manufacturers to reassess their sourcing strategies. As countries seek to bolster food security, there is a growing emphasis on local sourcing and production. This trend may lead to increased investments in domestic production facilities for feed intermediate chemicals, potentially reshaping market landscapes. The Feed Intermediate Chemicals Market could see a shift in competitive advantages as companies adapt to these changes, with an anticipated market growth of 5% as they enhance supply chain resilience and reduce dependency on international suppliers.