Increasing Awareness of Animal Health

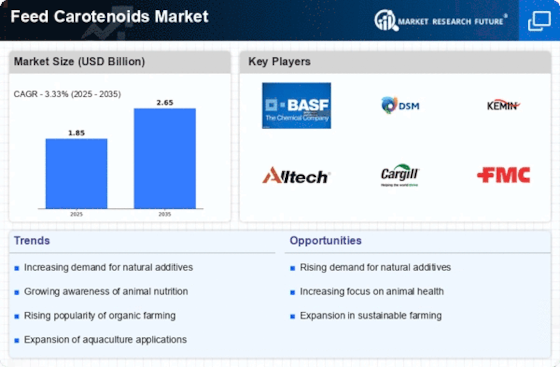

The Feed carotenoids Market is experiencing a notable surge in demand due to the increasing awareness surrounding animal health and nutrition. Livestock producers are becoming more cognizant of the benefits that carotenoids provide, such as enhancing immune function and improving overall health. This heightened awareness is likely to drive the adoption of carotenoid-rich feed additives, as they are perceived to contribute to better growth rates and feed efficiency. According to recent data, the market for feed additives, including carotenoids, is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This trend indicates a robust potential for the Feed Carotenoids Market as stakeholders prioritize animal welfare and health in their production practices.

Rising Demand for Natural Pigmentation

The Feed Carotenoids Market is witnessing a rising demand for natural pigmentation in animal feed. Carotenoids are known for their ability to enhance the color of animal products, such as egg yolks and poultry skin, which can significantly influence consumer preferences. As consumers increasingly seek natural and organic products, the demand for feed additives that provide natural pigmentation is likely to grow. This trend is further supported by the fact that the global market for natural colorants is expected to reach USD 3 billion by 2026, with carotenoids playing a pivotal role. Consequently, the Feed Carotenoids Market stands to benefit from this shift towards natural alternatives, as producers aim to meet consumer expectations for quality and aesthetics.

Regulatory Support for Natural Feed Additives

Regulatory support for natural feed additives is playing a crucial role in shaping the Feed Carotenoids Market. Governments and regulatory bodies are increasingly recognizing the benefits of natural ingredients in animal feed, leading to favorable policies and guidelines that promote their use. This regulatory environment encourages producers to incorporate carotenoids into their feed formulations, as they are often viewed as safer and more beneficial compared to synthetic alternatives. Additionally, the establishment of quality standards for feed additives is likely to enhance consumer confidence in products containing carotenoids. As a result, the Feed Carotenoids Market is expected to thrive, driven by supportive regulations that facilitate the adoption of natural feed solutions.

Technological Advancements in Feed Production

Technological advancements in feed production are significantly impacting the Feed Carotenoids Market. Innovations in extraction and formulation techniques have led to more efficient production processes, resulting in higher quality carotenoid products. These advancements not only enhance the bioavailability of carotenoids in animal feed but also reduce production costs, making them more accessible to a broader range of producers. Furthermore, the integration of precision nutrition and data analytics in feed formulation is likely to optimize the use of carotenoids, ensuring that animals receive the right nutrients for their growth and health. As a result, the Feed Carotenoids Market is poised for growth, driven by these technological improvements that enhance product efficacy and sustainability.

Growing Interest in Sustainable Livestock Farming

The Feed Carotenoids Market is benefiting from the growing interest in sustainable livestock farming practices. As environmental concerns rise, producers are increasingly seeking ways to reduce their carbon footprint and improve the sustainability of their operations. Carotenoids, being natural compounds, align well with these sustainability goals, as they can replace synthetic additives and contribute to healthier livestock. Moreover, the emphasis on reducing antibiotic use in animal husbandry has led to a greater reliance on natural feed additives like carotenoids to promote animal health. This shift towards sustainability is reflected in the increasing number of certifications and standards being adopted by producers, which further supports the growth of the Feed Carotenoids Market.