On July 13, 2023, CJ CheilJedang announced that its feed amino acid brand, Best Amino, has been selected as one of the Top 100 Global New Brands of 2023 by Clarivate Analytics, a global information service company. It is the only brand providing all feed amino acids produced using microbial fermentation technology.

Best Amino is recognized for its leading position in the global amino acid market. The company currently owns the world's largest feed amino acid portfolio with eight types, including lysine, methionine, threonine, and tryptophan, with tryptophan ranked first in the global market.

Mar.10, 2023, Corteva Inc. and Bunge announced their partnership to develop amino acid-enhanced soybeans. These companies are looking to boost the nutrition profile of soybean meal for poultry, swine, and aqua feed. They have significantly advanced in developing more nutritious soybean meal for the animal feed industry. This multi-year collaboration to develop and commercialize soybean varieties will enable feed compounders to reduce their carbon footprint by minimizing the synthetic additives use and lower costs.

On Feb.03, 2023, Farmers Business Network (FBN) and Boveta Nutrition, LLC, announced results from an FBN-managed independent study, trailing the partnership's amino acid balancing program. The farm managers believe the health of the cattle on the program and overall performance have improved significantly.

On Nov. 11, 2021, Kansas State University researchers announced the completion of work indicating that increased levels of a common feed-grade amino acid can significantly improve growth in swine herds. In its 43-day trial involving 912 pigs, researchers tested varying levels of feed-grade amino acids with L-lysine added to the late nursery and growing pigs' diet.

On July 06, 2021, Evonik published a comparative life cycle assessment (LCA), demonstrating the ecological advantages of using its feed amino acids and feeding solutions compared with common animal nutrition practices.

The animal nutrition business is part of Evonik's life sciences division, nutrition, and care. It develops sustainable solutions for a better life for people and animals. The company is concentrating all its knowledge and experience on developing targeted system solutions to meet the challenges of times.

Key players

Archer Daniels Midland Company (US), Sumitomo Corporation (Japan), Evonik Industries AG (Germany), CJ CheilJedang Corp. (South Korea), Ajinomoto Co.,Inc. (Japan), Bluestar Adisseo Co., Ltd. (France), Phibro Animal Health Corporation (US), Meihua Holdings Group Co., Ltd. (China), Kemin Industries, Inc. (US), Global Bio-chem Technology Group Company Limited (China), Novus International (US), and Sunrise Nutrachem Group (China) are some of the key players in the global market.

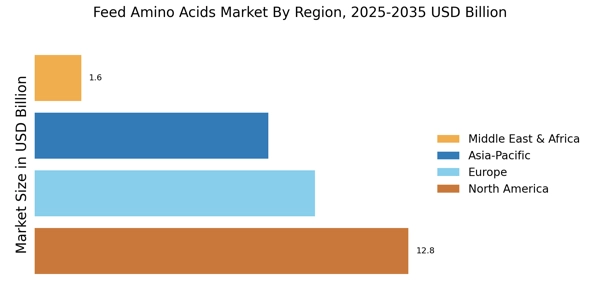

Regional Market Summary

Global Feed Amino Acids Market Share (%), by Region, 2021

Globally, Asia-Pacific dominates the market for feed amino acids owing to the continuous modernization of livestock production methods and the growing awareness of animal feed among consumers. High impact of feeding quality animal-based feed to the livestock has been boosting the demand for feed amino acids in this region.

Europe is generating a healthy revenue in the market. The European meat industry is infusing more amino acids in the animal feeds owing to the increasing consumption of quality meat by animals. North America is also growing in terms of meat demand in animal feed thereby contributing a decent share of revenue towards feed global amino acids market

Recent News

As of August 2023, Belarussian National Biotechnological Corporation (BNBC) has produced 500,000 tons of goods, including 50,000 tons of feed amino acids, since the project's inception. Despite the fact that Russia is BNBC's primary sales market, efforts are underway to diversify the supply. Registration requirements for Belarussian amino acids on the Brazilian market have been met. Belarus is gaining market share in Russia at an accelerating rate. According to the Russian think tank Feedlot, the nation currently provides 10% of the feed additives imported by Russia. At present, BNBC is contemplating the feasibility of augmenting its lysine monohydrochloride production capacity.

Additionally, within the next three years, the establishment of a feed vitamin manufacturing facility is also on the agenda. Uritsky stated that the Russian National Biotechnology Corporation could be established, however, within the [Russia-Belarus] Union State in collaboration with China. He estimated the investment cost of the project to be between $1.2 and $1.5 billion, adding that the Russian cluster's factories could annually process one million tons of grain.

Farmers Business Network, Inc., the worldwide AgTech platform and farmer-to-farmer network, introduced Profectus™ Feeds in October 2023. This innovative method of supplying beef cattle has the potential to enhance beef production's profitability and sustainability. The system, which was developed by a team of nutrition specialists and veterinarians at FBN Livestock, balances the energy consumption and amino acid requirements of beef diets in a manner analogous to how the swine industry reduced cost of gain by increasing feed efficiency through diet formulation.

Profectus Feeds have demonstrated a 5 to 15% improvement in feed-to-gain ratio and profitability when compared to conventional diet formulations in commercial studies and comparisons. Additionally, carcass value has been upheld or enhanced. Profectus Feeds acknowledges the absence of a protein requirement for cattle and formulates their diets in accordance with the amino acid requirement, which is calculated using the caloric density of the diet. This emphasis on the equilibrium of amino acids results in enhanced feed efficiency and, consequently, decreased cost of gain, fewer instances of digestive issues, and enhanced environmental sustainability.

Global Market, by Type

- Lysine

- Methionine

- Threonine

- Tryptophan

- Others

Global Market, by Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

Global Market, by Form

Global Market, by Region

- North America

- Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia & New Zealand

- Rest of Asia-Pacific

- Rest of the World (RoW)

- South America

- Middle East

- Africa

Intended Audience

- Feed amino acids producers/ processors

- Commercial research & development (R&D) institutions

- Raw material suppliers and distributors

- Government and research organizations

- Farmers, poultry owners, and cattle owners

- Associations and industrial bodies

- Retailers, supermarket, and hypermarket

- Traders, exporters, and importers