Top Industry Leaders in the Fatty Acid Market

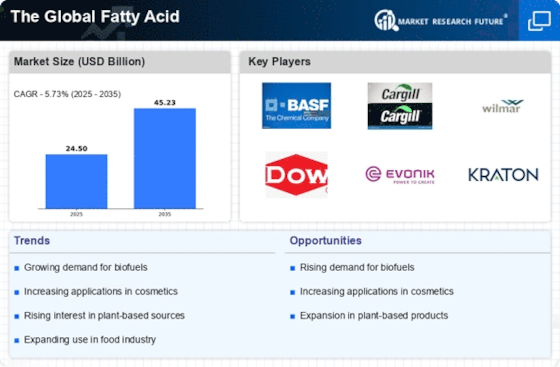

The fatty acid market has witnessed significant growth, driven by the diverse applications of fatty acids in various industries, including food, pharmaceuticals, and cosmetics. Key players in this sector are strategically positioning themselves to cater to the increasing demand for functional and nutritional ingredients. This analysis provides insights into the key players, strategies adopted, factors influencing market share, emerging companies, industry trends, overall competitive scenario, and a recent development in 2023.

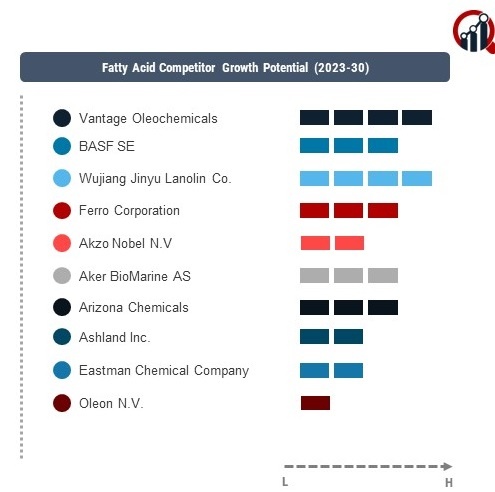

Key Players:

BASF SE (Germany)

Akzo Nobel N.V (Netherlands)

Ashland Inc. (US)

WujiangJinyu Lanolin Co. (China)

Vantage Oleochemicals (US)

Aker BioMarine AS (Norway)

Ferro Corporation (US)

Oleon N.V. (Belgium)

Arizona Chemicals (US)

Eastman Chemical Company (US)

Colgate-Palmolive Ltd (India)

Godrej Industries (India)

Ferro Corporation (US)

LongyanZhuoyue New Energy Co. Ltd. (China)

Eastman Chemical Corporation (US).

Strategies Adopted:

Market Share Analysis:

New & Emerging Companies:

Industry Trends:

Recent industry developments highlight a growing trend towards omega-3 fatty acids and their health benefits. Major players are investing in research to explore the potential health advantages of omega-3 fatty acids, particularly in cardiovascular health and cognitive function. Additionally, there is an increased focus on fortifying food and nutritional products with omega-3 fatty acids to meet the rising consumer demand for functional and healthy ingredients.

In terms of investment trends, companies are exploring technologies to enhance production efficiency and reduce the carbon footprint of fatty acid production. Investments in sustainable practices, such as waste reduction and energy efficiency, are becoming integral to the industry's commitment to environmental responsibility.

Competitive Scenario:

The competitive landscape of the fatty acid market is dynamic, with established players adapting to emerging trends and new entrants exploring innovative solutions. The focus on vertical integration, sustainability, and diversified applications remains central to the overall competitive scenario.

Recent Development

The fatty acid market was the increased focus on personalized nutrition. Major players introduced initiatives to develop personalized fatty acid formulations that address individual health needs and dietary preferences. This development aligns with the broader trend towards personalized nutrition and the recognition that consumers have unique nutritional requirements. Companies invested in research and development to understand the role of fatty acids in personalized health and formulated products catering to specific health goals. This shift towards personalized nutrition reflects the industry's commitment to meeting the evolving demands of health-conscious consumers and offering tailored solutions in the fatty acid market.