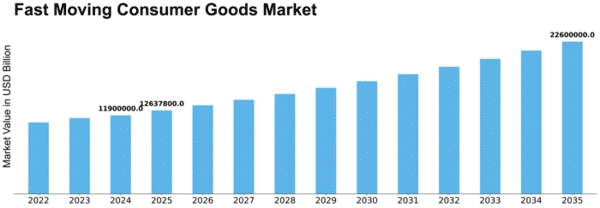

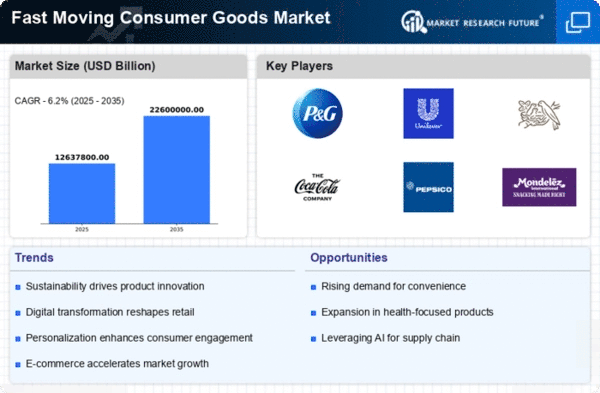

Fast Moving Consumer Goods Size

Fast Moving Consumer Goods Market Growth Projections and Opportunities

The fast-moving consumer goods (FMCG) market is influenced by various dynamic factors that shape its growth, trends, and consumer behavior. One significant factor driving the dynamics of the FMCG market is consumer demand for convenience, affordability, and accessibility. FMCG products, such as food and beverages, personal care items, household cleaning products, and over-the-counter medications, are everyday essentials that consumers purchase frequently and rely on for their daily needs. As a result, consumers prioritize convenience and value when selecting FMCG products, favoring brands and products that offer convenience packaging, competitive pricing, and widespread availability through multiple retail channels, including supermarkets, convenience stores, e-commerce platforms, and neighborhood mom-and-pop shops.

Moreover, market dynamics within the FMCG industry are influenced by changing consumer lifestyles and preferences. As consumers lead increasingly busy and hectic lives, they seek out FMCG products that align with their on-the-go lifestyles, dietary preferences, and wellness goals. This has led to a growing demand for healthier, organic, and natural FMCG products, as well as convenient, single-serve options and ready-to-eat meals that cater to busy schedules and dietary restrictions. Additionally, as consumers become more health-conscious and environmentally aware, there is a growing interest in sustainable and eco-friendly FMCG products that promote sustainability, reduce waste, and minimize environmental impact throughout the product lifecycle.

Furthermore, technological advancements and digitalization drive market dynamics within the FMCG industry. FMCG companies leverage technology to optimize supply chain management, streamline operations, and enhance marketing and distribution efforts. Data analytics and artificial intelligence enable FMCG companies to analyze consumer behavior, predict trends, and personalize marketing strategies, leading to more targeted and effective product promotions. Additionally, e-commerce platforms and digital marketplaces provide FMCG companies with new opportunities to reach consumers directly, bypassing traditional retail channels and offering convenience, accessibility, and personalized shopping experiences.

Supply chain dynamics and production trends also impact market dynamics within the FMCG industry. FMCG companies must manage complex and efficient supply chains to ensure timely delivery, freshness, and availability of products to meet consumer demand. Disruptions such as natural disasters, supply shortages, and global events, such as the COVID-19 pandemic, can impact production, distribution, and supply of FMCG products, leading to supply chain bottlenecks, shortages, and changes in consumer purchasing behavior. Moreover, changes in raw material costs, transportation expenses, and currency exchange rates can affect production costs and pricing strategies within the FMCG industry, influencing market dynamics and profitability for FMCG companies.

Additionally, marketing and branding play a crucial role in shaping market dynamics within the FMCG industry. FMCG companies invest in marketing strategies that emphasize brand recognition, loyalty, and differentiation to stand out in a crowded marketplace. Branding elements such as packaging design, logo, and brand messaging help FMCG companies create a distinctive identity and communicate product benefits and value propositions to consumers. Moreover, promotional tactics such as advertising campaigns, in-store promotions, and digital marketing initiatives are used to drive brand awareness, engage consumers, and stimulate demand for FMCG products.

Regulatory standards and compliance requirements also impact market dynamics in the FMCG industry. FMCG companies must comply with regulations related to product safety, labeling, and advertising to ensure the safety and integrity of their products. Additionally, FMCG companies must adhere to food safety standards, hygiene protocols, and quality control measures to maintain consumer trust and confidence in their products. Moreover, environmental regulations and sustainability initiatives drive FMCG companies to adopt eco-friendly practices, reduce carbon emissions, and minimize waste throughout the product lifecycle, from sourcing and manufacturing to distribution and disposal.

Leave a Comment