Market Growth Projections

The Global Fabless IC Market Industry is projected to experience substantial growth, with estimates indicating a market size of 720.2 USD Billion by 2035. This remarkable increase reflects the ongoing demand for innovative semiconductor solutions across various sectors. The anticipated compound annual growth rate of 17.91% from 2025 to 2035 highlights the industry's potential for expansion. As technology continues to evolve, the fabless model is likely to gain further traction, enabling companies to respond swiftly to market changes and consumer needs. This growth trajectory underscores the importance of strategic planning and investment in the fabless sector.

Increased Investment in R&D

Investment in research and development is a critical driver for the Global Fabless IC Market Industry. Companies are allocating substantial resources to innovate and develop next-generation semiconductor technologies. This focus on R&D not only enhances product offerings but also fosters collaboration between fabless firms and foundries, leading to more efficient manufacturing processes. As the market evolves, these investments are likely to yield advanced solutions that meet the demands of various sectors, including automotive, healthcare, and telecommunications. The anticipated growth in the market underscores the importance of continuous innovation in maintaining competitive advantage.

Growth of Internet of Things (IoT)

The expansion of the Internet of Things (IoT) plays a pivotal role in shaping the Global Fabless IC Market Industry. As more devices become interconnected, the demand for specialized chips that can handle vast amounts of data and facilitate communication between devices increases. This trend is particularly evident in smart homes and industrial automation, where fabless ICs are essential for enabling seamless connectivity. The market's growth trajectory is expected to align with the increasing number of IoT devices, which could reach billions by 2035, further driving the demand for innovative fabless solutions.

Emerging Markets and Global Expansion

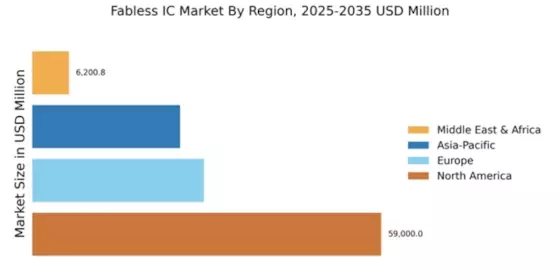

Emerging markets are becoming increasingly significant in the Global Fabless IC Market Industry. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization and urbanization, leading to heightened demand for electronic devices. As these regions develop, the need for fabless ICs to support local manufacturing and technology initiatives grows. This expansion into new markets presents opportunities for fabless companies to diversify their portfolios and tap into new revenue streams. The global nature of the market suggests that companies must adapt their strategies to cater to the unique needs of these emerging economies, further driving growth.

Rising Demand for Consumer Electronics

The Global Fabless IC Market Industry experiences a notable surge in demand driven by the proliferation of consumer electronics. As households increasingly adopt smart devices, the need for advanced integrated circuits becomes paramount. In 2024, the market is projected to reach 117.6 USD Billion, reflecting the growing reliance on technology in daily life. This trend is likely to continue as innovations in smartphones, tablets, and wearables necessitate more sophisticated chip designs. The integration of artificial intelligence and machine learning into these devices further amplifies the demand for fabless ICs, suggesting a robust growth trajectory in the coming years.

Advancements in Semiconductor Technology

Technological advancements in semiconductor manufacturing significantly influence the Global Fabless IC Market Industry. Innovations such as FinFET and 3D IC technologies enhance performance while reducing power consumption, making fabless designs more appealing. These advancements allow companies to produce smaller, more efficient chips that cater to the needs of various applications, from automotive to IoT devices. As the industry evolves, the market is expected to witness a compound annual growth rate of 17.91% from 2025 to 2035, indicating a strong future for fabless ICs as they adapt to emerging technologies and consumer demands.