Government Incentives and Policies

Government incentives and supportive policies play a crucial role in shaping the Export Offshore Wind Cable Market. Many countries are implementing favorable regulations and financial incentives to promote the development of offshore wind energy. For example, feed-in tariffs and tax credits are being utilized to encourage investments in renewable energy infrastructure. These initiatives not only stimulate the growth of offshore wind projects but also create a favorable environment for the export of specialized cables. As governments commit to ambitious renewable energy targets, the Export Offshore Wind Cable Market is likely to experience increased demand driven by these supportive measures, fostering a more robust market landscape.

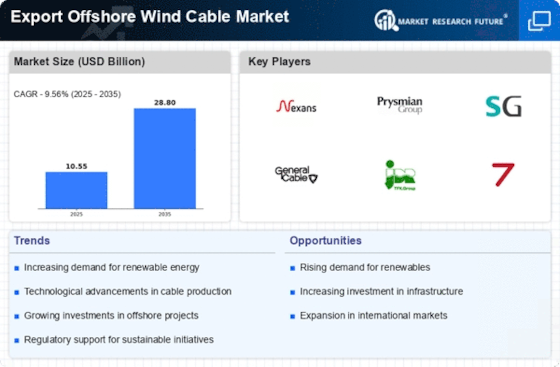

Rising Demand for Renewable Energy

The increasing The Export Offshore Wind Cable Industry. As nations strive to meet their energy needs sustainably, offshore wind energy has emerged as a viable solution. According to recent data, offshore wind capacity is projected to reach over 200 GW by 2030, necessitating a robust supply of specialized cables for energy transmission. This surge in demand for renewable energy infrastructure is likely to propel investments in offshore wind projects, thereby enhancing the market for export offshore wind cables. The Export Offshore Wind Cable Market is expected to benefit from this trend as countries invest in cleaner energy alternatives, leading to a heightened need for efficient and durable cable solutions.

Focus on Energy Security and Independence

The focus on energy security and independence is increasingly influencing the Export Offshore Wind Cable Market. As countries seek to reduce their reliance on fossil fuels and enhance their energy autonomy, offshore wind energy is being recognized as a strategic solution. This shift is prompting governments and private entities to invest in offshore wind infrastructure, thereby driving demand for export offshore wind cables. The need for reliable energy sources is likely to propel the development of new offshore wind farms, which will require extensive cable networks for energy distribution. Consequently, the Export Offshore Wind Cable Market is expected to thrive as nations prioritize energy security through the expansion of renewable energy capabilities.

Growing Investment in Offshore Wind Projects

The growing investment in offshore wind projects is a significant driver for the Export Offshore Wind Cable Market. With numerous countries announcing ambitious offshore wind capacity targets, investments are surging. For instance, recent reports indicate that investments in offshore wind projects could exceed 100 billion USD by 2030. This influx of capital is expected to lead to the construction of new wind farms, which in turn will require substantial quantities of specialized cables for energy transmission. As the industry continues to attract investment, the Export Offshore Wind Cable Market is poised for growth, driven by the increasing need for efficient and reliable cable solutions to support these large-scale projects.

Technological Advancements in Cable Manufacturing

Technological advancements in cable manufacturing processes are significantly influencing the Export Offshore Wind Cable Market. Innovations such as improved materials and manufacturing techniques have led to the production of cables that are not only more efficient but also more resilient to harsh marine environments. For instance, the introduction of high-capacity, lightweight cables has the potential to reduce installation costs and enhance energy transmission efficiency. As the industry evolves, manufacturers are likely to adopt these advanced technologies to meet the growing demands of offshore wind projects. This trend suggests that the Export Offshore Wind Cable Market will continue to expand as companies seek to leverage these innovations to improve their competitive edge.