Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the EV Battery Pack Market. Many countries are implementing stringent regulations aimed at reducing greenhouse gas emissions, which directly impacts the automotive sector. For instance, various governments are offering tax credits, rebates, and grants to consumers who purchase electric vehicles, thereby stimulating demand for EV battery packs. In 2025, it is anticipated that these incentives will lead to a 25% increase in electric vehicle sales, consequently driving the need for more efficient and cost-effective battery solutions. This supportive regulatory environment not only encourages manufacturers to innovate but also fosters a competitive landscape within the EV Battery Pack Market.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver of the EV Battery Pack Market. As more individuals and businesses recognize the environmental benefits and cost savings associated with EVs, the demand for efficient battery packs surges. In 2025, it is estimated that the number of electric vehicles on the road will exceed 30 million units, significantly boosting the need for advanced battery technologies. This trend is further supported by government incentives and regulations aimed at reducing carbon emissions, which encourage the adoption of electric mobility solutions. Consequently, the EV Battery Pack Market is poised for substantial growth as manufacturers strive to meet the escalating demand for high-performance battery packs that enhance the driving range and efficiency of electric vehicles.

Growing Focus on Renewable Energy Integration

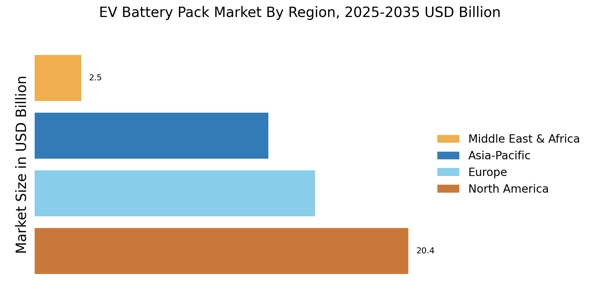

The integration of renewable energy sources into the power grid is increasingly influencing the EV Battery Pack Market. As the world shifts towards sustainable energy solutions, the demand for energy storage systems that can efficiently store and manage renewable energy is rising. Battery packs used in electric vehicles can serve as a vital component in this ecosystem, enabling the storage of excess energy generated from solar and wind sources. By 2025, it is projected that the energy storage market will reach USD 20 billion, highlighting the potential for synergies between renewable energy and electric mobility. This trend not only enhances the appeal of electric vehicles but also positions the EV Battery Pack Market as a key player in the transition to a more sustainable energy future.

Technological Innovations in Battery Chemistry

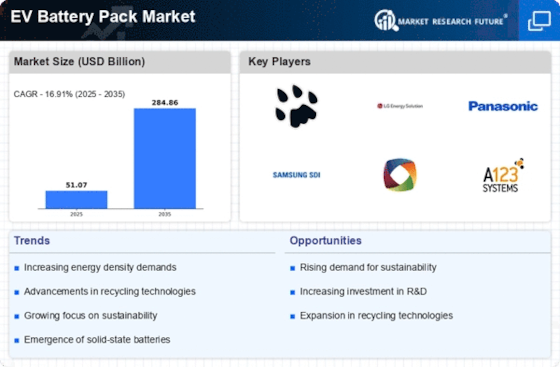

Technological advancements in battery chemistry are transforming the EV Battery Pack Market. Innovations such as solid-state batteries and lithium-sulfur technologies promise to deliver higher energy densities and improved safety profiles compared to traditional lithium-ion batteries. These developments could potentially lead to battery packs that not only last longer but also charge faster, addressing one of the key concerns of EV users. As of 2025, the market for solid-state batteries is projected to reach USD 5 billion, indicating a robust interest in next-generation battery solutions. This shift towards innovative battery technologies is likely to enhance the overall performance of electric vehicles, thereby driving further growth in the EV Battery Pack Market.

Increased Investment in Research and Development

Investment in research and development (R&D) is a significant driver of the EV Battery Pack Market. As competition intensifies among manufacturers, there is a growing emphasis on developing advanced battery technologies that can offer superior performance and lower costs. In 2025, R&D spending in the battery sector is expected to exceed USD 10 billion, reflecting the industry's commitment to innovation. This influx of capital is likely to accelerate the development of next-generation battery packs, which could include features such as enhanced energy density, faster charging times, and improved lifecycle performance. Such advancements are essential for meeting the evolving demands of consumers and ensuring the long-term viability of the EV Battery Pack Market.