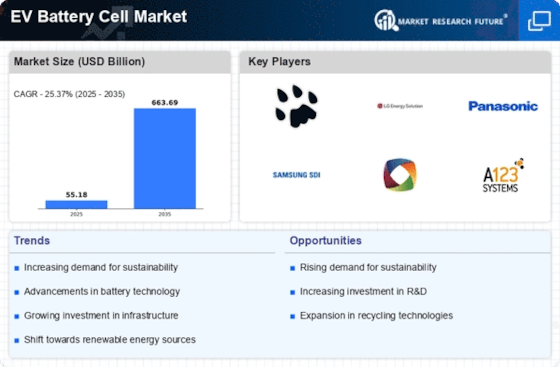

Growing Focus on Sustainability

The increasing emphasis on sustainability is significantly influencing the EV Battery Cell Market. Consumers are becoming more environmentally conscious, leading to a demand for eco-friendly battery solutions. Manufacturers are responding by developing batteries that utilize sustainable materials and are designed for recyclability. The market for recycled battery materials is projected to grow, with estimates suggesting that by 2025, the recycling rate for lithium-ion batteries could reach 50%. This shift not only reduces the environmental impact of battery production but also addresses concerns regarding resource scarcity. As sustainability becomes a core value for consumers, the EV Battery Cell Market is likely to experience a surge in demand for batteries that align with these principles.

Advancements in Battery Technology

Technological innovations in battery chemistry and design are propelling the EV Battery Cell Market forward. Recent developments in solid-state batteries and lithium-sulfur technologies promise to deliver higher energy densities and faster charging times. For instance, solid-state batteries are projected to increase energy density by up to 50%, which could revolutionize the performance of electric vehicles. As manufacturers invest in research and development, the market is likely to witness a shift towards more efficient and sustainable battery solutions. This evolution not only enhances the driving experience but also aligns with the growing consumer demand for longer-lasting and quicker-charging electric vehicles, thereby driving the expansion of the EV Battery Cell Market.

Government Policies and Incentives

Supportive government policies and incentives play a crucial role in shaping the EV Battery Cell Market. Many countries are implementing stringent regulations aimed at reducing greenhouse gas emissions, which directly impacts the automotive sector. For example, several nations have set ambitious targets for phasing out internal combustion engines, thereby accelerating the transition to electric mobility. Additionally, financial incentives such as tax credits and rebates for EV purchases encourage consumers to opt for electric vehicles. As a result, the demand for high-quality battery cells is expected to rise, prompting manufacturers to enhance their production capabilities and invest in innovative technologies within the EV Battery Cell Market.

Rising Demand for Electric Vehicles

The increasing consumer preference for electric vehicles (EVs) is a primary driver of the EV Battery Cell Market. As more individuals and businesses recognize the environmental benefits and cost savings associated with EVs, the demand for efficient battery cells surges. In 2025, it is estimated that the number of electric vehicles on the road will exceed 30 million, significantly boosting the need for advanced battery technologies. This trend is further supported by government incentives and regulations aimed at reducing carbon emissions, which encourage the adoption of EVs. Consequently, the EV Battery Cell Market is poised for substantial growth as manufacturers strive to meet the escalating demand for high-performance battery cells that enhance the range and efficiency of electric vehicles.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a vital driver for the EV Battery Cell Market. As more charging stations are installed in urban and rural areas, the convenience of owning an electric vehicle increases, thereby encouraging more consumers to make the switch from traditional vehicles. In 2025, the number of public charging stations is expected to surpass 1 million, facilitating easier access to charging for EV owners. This growth in infrastructure not only alleviates range anxiety but also supports the overall adoption of electric vehicles. Consequently, as the market for electric vehicles expands, the demand for high-performance battery cells will likely rise, further propelling the EV Battery Cell Market.