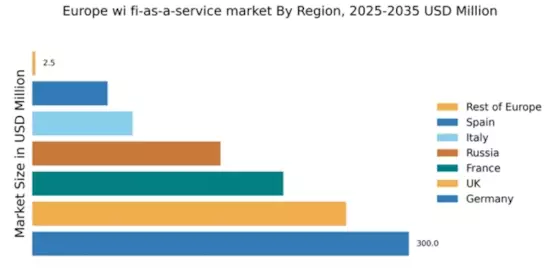

Germany : Strong Infrastructure and Demand Growth

Key markets include major cities like Berlin, Munich, and Frankfurt, where demand for high-speed connectivity is surging. The competitive landscape features strong players such as Cisco Systems, Aruba Networks, and Extreme Networks, all vying for market share. Local dynamics are characterized by a robust business environment, with sectors like healthcare, education, and manufacturing increasingly adopting Wi-Fi solutions to enhance operational efficiency and connectivity.

UK : Innovation and Connectivity Drive Demand

Key markets include London, Manchester, and Birmingham, where businesses are rapidly adopting Wi-Fi solutions. The competitive landscape is marked by the presence of major players like Cisco Systems and Meraki, alongside local providers. The business environment is vibrant, with sectors such as retail, education, and hospitality increasingly leveraging Wi-Fi services to enhance customer experiences and operational efficiency.

France : Strong Demand in Urban Areas

Key markets include Paris, Lyon, and Marseille, where demand for high-speed internet is growing. The competitive landscape features major players like Cisco Systems and Ruckus Networks, alongside local providers. The business environment is dynamic, with sectors such as tourism, education, and healthcare increasingly adopting Wi-Fi solutions to improve service delivery and customer engagement.

Russia : Infrastructure Development and Adoption

Key markets include Moscow, St. Petersburg, and Kazan, where demand for reliable connectivity is on the rise. The competitive landscape includes major players like Cisco Systems and TP-Link, alongside local providers. The business environment is improving, with sectors such as retail, education, and public services increasingly adopting Wi-Fi solutions to enhance operational efficiency and customer satisfaction.

Italy : Urbanization Fuels Connectivity Needs

Key markets include Rome, Milan, and Naples, where demand for high-speed connectivity is growing. The competitive landscape features players like Cisco Systems and Ubiquiti Networks, alongside local providers. The business environment is evolving, with sectors such as tourism, retail, and education increasingly adopting Wi-Fi solutions to enhance customer experiences and operational efficiency.

Spain : Digital Transformation Drives Growth

Key markets include Madrid, Barcelona, and Valencia, where demand for reliable connectivity is surging. The competitive landscape includes major players like Cisco Systems and Meraki, alongside local providers. The business environment is vibrant, with sectors such as tourism, education, and retail increasingly leveraging Wi-Fi solutions to improve service delivery and customer engagement.

Rest of Europe : Diverse Needs Across Regions

Key markets include smaller cities and rural areas across various countries, where demand for reliable connectivity is emerging. The competitive landscape is fragmented, with local providers and smaller players dominating. The business environment varies, with sectors such as agriculture, education, and healthcare increasingly adopting Wi-Fi solutions to meet specific connectivity needs.