Growing Demand for 5G Connectivity

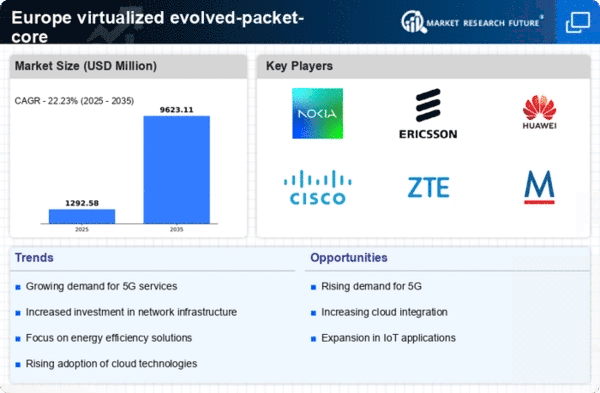

The increasing demand for 5G connectivity in Europe is a primary driver for the virtualized evolved-packet-core market. As mobile operators strive to enhance their network capabilities, the need for efficient and scalable core network solutions becomes paramount. The European telecommunications sector is projected to invest approximately €50 billion in 5G infrastructure by 2026, which is likely to accelerate the adoption of virtualized core solutions. This shift not only supports higher data rates but also enables low-latency applications, thereby enhancing user experience. Consequently, the virtualized evolved-packet-core market is expected to witness substantial growth as operators seek to modernize their networks to meet the evolving demands of consumers and businesses alike.

Cost Efficiency and Operational Flexibility

Cost efficiency remains a crucial driver for the virtualized evolved-packet-core market in Europe. Telecommunications operators are increasingly seeking ways to reduce operational expenditures while maintaining high service quality. Virtualized solutions offer significant savings by minimizing the need for proprietary hardware and enabling the use of commercial off-the-shelf (COTS) equipment. This shift can lead to a reduction in capital expenditures by up to 30%, allowing operators to allocate resources more effectively. Furthermore, the operational flexibility provided by virtualized networks enables rapid deployment of new services, which is essential in a competitive landscape. As a result, the virtualized evolved-packet-core market is likely to expand as operators prioritize cost-effective solutions.

Rising Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) applications in Europe is driving the demand for advanced network solutions, including the virtualized evolved-packet-core market. With millions of devices expected to connect to networks, the need for robust and scalable core infrastructure is becoming increasingly apparent. Analysts estimate that the number of IoT devices in Europe could reach 1 billion by 2025, necessitating a shift towards more flexible and efficient network architectures. Virtualized core networks are well-suited to handle the diverse requirements of IoT applications, such as low power consumption and real-time data processing. Consequently, this trend is likely to propel the growth of the virtualized evolved-packet-core market as operators adapt to the evolving landscape.

Regulatory Support for Network Virtualization

Regulatory frameworks in Europe are increasingly favoring network virtualization, which serves as a significant driver for the virtualized evolved-packet-core market. The European Commission has been advocating for policies that promote digital transformation and innovation within the telecommunications sector. Initiatives aimed at fostering competition and reducing barriers to entry for new players are likely to enhance the adoption of virtualized solutions. As a result, operators are encouraged to invest in advanced technologies, leading to a projected market growth of around 15% annually over the next five years. This regulatory support not only facilitates the deployment of virtualized core networks but also ensures that operators can adapt to changing market dynamics effectively.

Enhanced User Experience through Network Slicing

Network slicing is emerging as a transformative approach in the telecommunications sector, significantly impacting the virtualized evolved-packet-core market. This technology allows operators to create multiple virtual networks on a single physical infrastructure, tailored to specific user requirements. In Europe, the demand for personalized services is on the rise, with consumers expecting seamless connectivity and optimized performance. By leveraging network slicing, operators can enhance user experience while efficiently managing resources. The market for network slicing is projected to grow at a CAGR of 20% over the next five years, indicating a strong potential for the virtualized evolved-packet-core market to thrive as operators implement this innovative approach.