Growth of Mobile Streaming Services

The proliferation of mobile devices significantly influences the video streaming-software market in Europe. With smartphone penetration exceeding 90% in many European countries, consumers increasingly turn to mobile platforms for their viewing needs. This trend is reflected in the rising number of mobile streaming subscriptions, which have grown by approximately 30% over the past year. As a result, software providers are compelled to optimize their applications for mobile use, ensuring compatibility across various devices and operating systems. The convenience of mobile streaming not only caters to on-the-go consumers but also opens new revenue streams through targeted advertising and in-app purchases. This growth in mobile streaming services indicates a shift in how content is consumed, prompting companies to adapt their strategies to capture this expanding audience in the video streaming-software market.

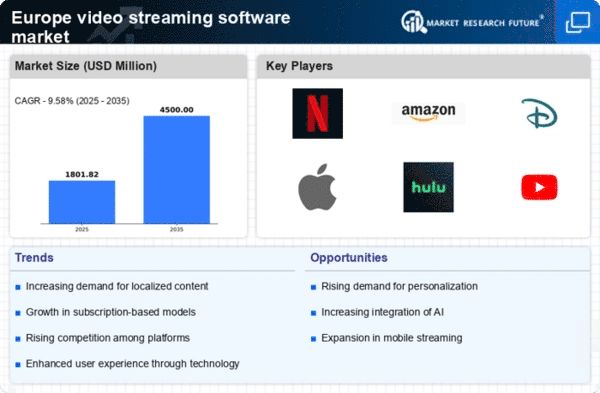

Rising Demand for On-Demand Content

The video streaming software market in Europe is experiencing a notable surge in demand for on-demand content. This shift is driven by changing consumer preferences, as audiences increasingly favor the flexibility of watching content at their convenience. According to recent data, approximately 70% of European consumers prefer on-demand services over traditional broadcasting. This trend compels software providers to enhance their platforms, ensuring seamless access to a diverse range of content. As a result, the industry witnesses a proliferation of subscription-based models, which are projected to account for over 50% of total revenue in the coming years. The growing appetite for personalized viewing experiences further fuels this demand, prompting companies to invest in advanced algorithms that tailor content recommendations to individual users. Thus, the rising demand for on-demand content significantly shapes the video streaming-software market in Europe.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements significantly impact the video streaming-software market in Europe. The implementation of the European Union's Audiovisual Media Services Directive (AVMSD) mandates that streaming platforms allocate a certain percentage of their content to European works. This regulation, which aims to promote local content, influences the strategies of software providers as they navigate compliance while maintaining a diverse content library. Additionally, data protection regulations, such as the General Data Protection Regulation (GDPR), impose strict guidelines on how user data is handled, compelling companies to invest in robust security measures. These regulatory frameworks not only shape operational practices but also affect market dynamics, as companies that adapt effectively may gain a competitive edge. Thus, the evolving regulatory landscape presents both challenges and opportunities within the video streaming-software market in Europe.

Technological Advancements in Streaming Quality

Technological advancements play a pivotal role in shaping the video streaming-software market in Europe. Innovations such as 4K and 8K streaming capabilities, along with improved compression algorithms, enhance the viewing experience for consumers. Recent statistics indicate that over 40% of European households now possess 4K-capable devices, leading to an increased expectation for high-quality content delivery. Furthermore, the integration of adaptive bitrate streaming technology allows for smoother playback, even in varying network conditions. This technological evolution not only attracts new subscribers but also retains existing ones, as users are more likely to remain loyal to platforms that offer superior quality. Consequently, the emphasis on streaming quality drives competition among software providers, compelling them to continuously upgrade their offerings to meet consumer expectations in the video streaming-software market.

Increased Investment in Original Content Production

Investment in original content production emerges as a crucial driver in the video streaming-software market in Europe. As competition intensifies among streaming platforms, companies recognize the need to differentiate themselves through exclusive content offerings. Recent reports suggest that spending on original programming in Europe has surged by over 25% in the last year alone. This trend not only enhances the attractiveness of platforms but also fosters viewer loyalty, as audiences are drawn to unique and high-quality productions. Furthermore, partnerships with local creators and production houses enable platforms to cater to regional tastes and preferences, thereby expanding their subscriber base. The increased investment in original content production reflects a strategic shift within the industry, as companies strive to establish themselves as leaders in the evolving video streaming-software market.