Rising Demand for Video Content

The increasing consumption of video content across various platforms appears to be a primary driver for the Video Content Analytics Market. As more businesses and individuals turn to video as a medium for communication, marketing, and entertainment, the need for analytics to measure engagement and effectiveness becomes crucial. Reports indicate that video content is projected to account for over 80% of all internet traffic by 2025. This surge in demand necessitates advanced analytics tools to help organizations understand viewer behavior, optimize content, and enhance user experience. Consequently, the Video Content Analytics Market is likely to witness substantial growth as companies seek to leverage data-driven insights to improve their video strategies.

Increased Focus on Marketing ROI

As businesses continue to invest heavily in video marketing, there is a growing emphasis on measuring return on investment (ROI) from these campaigns. The Video Content Analytics Market is responding to this trend by providing tools that help organizations track and analyze the performance of their video content. Companies are increasingly seeking to understand which videos drive conversions, engagement, and customer retention. This focus on ROI is likely to propel the demand for analytics solutions that can provide actionable insights. Market data suggests that organizations that utilize video analytics are more likely to achieve higher engagement rates and improved marketing outcomes, further underscoring the importance of analytics in the Video Content Analytics Market.

Adoption of Advanced Technologies

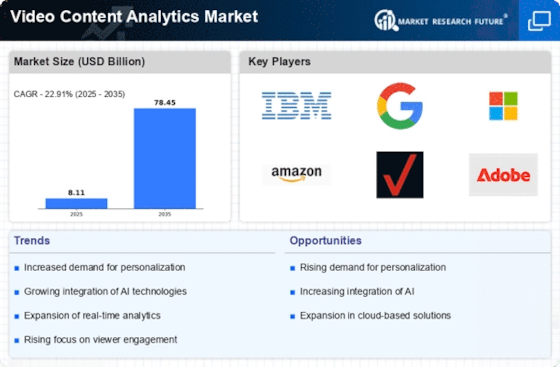

The integration of advanced technologies such as artificial intelligence and machine learning into video content analytics is transforming the Video Content Analytics Market. These technologies enable more sophisticated data processing and analysis, allowing for deeper insights into viewer preferences and behaviors. For instance, AI-driven analytics can automate the identification of trends and patterns in video consumption, which can lead to more effective content strategies. The market for AI in video analytics is expected to grow significantly, with estimates suggesting a compound annual growth rate of over 25% in the coming years. This technological advancement not only enhances the capabilities of analytics tools but also drives the demand for innovative solutions within the Video Content Analytics Market.

Growth of Over-the-Top (OTT) Services

The proliferation of over-the-top (OTT) streaming services is significantly impacting the Video Content Analytics Market. As more consumers shift from traditional cable to OTT platforms, the demand for analytics to understand viewer behavior on these services is increasing. OTT providers are leveraging analytics to optimize content delivery, enhance user experience, and tailor offerings to specific audience segments. Market Research Future indicates that the OTT market is expected to reach a valuation of over 1 trillion dollars by 2027, which suggests a robust opportunity for analytics providers. This growth in OTT services is likely to drive innovation and competition within the Video Content Analytics Market, as companies strive to offer advanced solutions that meet the evolving needs of content providers.

Regulatory Compliance and Data Privacy

The evolving landscape of data privacy regulations is influencing the Video Content Analytics Market. As organizations collect and analyze viewer data, they must navigate complex legal frameworks to ensure compliance with regulations such as GDPR and CCPA. This necessity for compliance is driving the demand for analytics solutions that prioritize data security and privacy. Companies are increasingly looking for tools that not only provide insights but also adhere to regulatory standards. The market for privacy-focused analytics solutions is expected to grow as businesses seek to balance the need for data-driven insights with the imperative of protecting consumer information. This trend highlights the critical role of compliance in shaping the Video Content Analytics Market.