Regulatory Compliance and Standards

the telecom billing-revenue-management market in Europe is influenced by stringent regulatory frameworks. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the European Electronic Communications Code (EECC) necessitates robust billing systems that ensure data protection and transparency. As telecom operators strive to meet these legal requirements, investments in advanced billing solutions are likely to rise. This trend is expected to drive market growth, as companies seek to avoid hefty fines and maintain customer trust. The need for compliance may lead to an estimated increase of 15% in spending on billing systems over the next few years, reflecting the critical nature of regulatory adherence in the telecom sector.

Focus on Enhanced Customer Experience

Enhancing customer experience is becoming a pivotal driver in the telecom billing-revenue-management market in Europe. As competition intensifies, telecom operators are prioritizing customer satisfaction through personalized billing experiences. This includes offering detailed billing statements, flexible payment options, and responsive customer support. The market is projected to expand by 19% as companies invest in technologies that facilitate better customer engagement and feedback mechanisms. By focusing on customer-centric billing practices, telecom operators can differentiate themselves in a crowded market, ultimately leading to increased loyalty and revenue growth.

Shift Towards Subscription-Based Models

the telecom billing-revenue-management market in Europe is experiencing a notable shift towards subscription-based business models. This transition is driven by changing consumer preferences for flexible payment options and bundled services. As telecom operators adapt to this trend, they require sophisticated billing systems capable of managing recurring payments and complex pricing structures. This shift is expected to contribute to a market growth rate of around 18% as companies invest in solutions that can efficiently handle subscription billing. The ability to offer personalized pricing and promotions will likely enhance customer retention and attract new subscribers.

Technological Advancements in Billing Systems

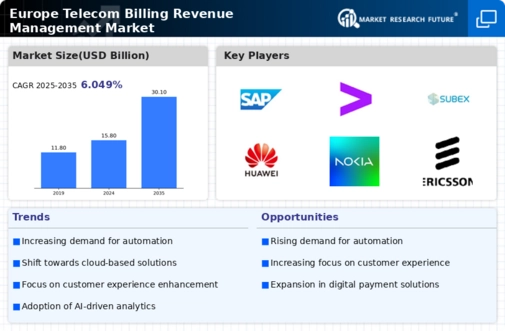

Rapid technological advancements are reshaping the telecom billing-revenue-management market in Europe. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into billing systems, enhancing efficiency and accuracy. These technologies enable telecom operators to automate billing processes, reduce errors, and improve customer satisfaction. The market is projected to grow by approximately 20% as companies adopt these advanced solutions to streamline operations. Furthermore, the integration of AI-driven analytics allows for better forecasting and revenue management, positioning telecom operators to respond swiftly to market changes and customer demands.

Increased Demand for Real-Time Billing Solutions

The demand for real-time billing solutions is surging within the telecom billing-revenue-management market in Europe. Customers increasingly expect immediate access to their billing information and the ability to make payments on-the-go. This trend is prompting telecom operators to invest in systems that provide real-time data processing and analytics. The market is anticipated to grow by 22% as companies implement these solutions to enhance customer experience and operational efficiency. Real-time billing not only improves customer satisfaction but also enables operators to manage cash flow more effectively, thereby strengthening their financial position.