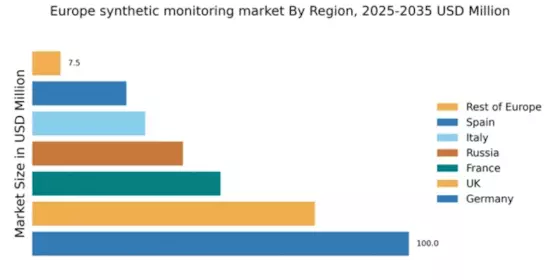

Germany : Germany's Dominance in Technology

Key markets include Berlin, Munich, and Frankfurt, where major tech hubs are located. The competitive landscape features prominent players like Dynatrace and New Relic, which have established strong footholds. Local dynamics favor innovation, with a focus on sectors such as finance, e-commerce, and telecommunications. The business environment is characterized by a high level of investment in technology and a skilled workforce, making it conducive for synthetic monitoring solutions.

UK : UK's Evolving Digital Landscape

London, Manchester, and Birmingham are pivotal markets, hosting numerous tech companies and startups. The competitive landscape includes major players like AppDynamics and Datadog, which are well-positioned to capture market share. The local business environment is dynamic, with a strong emphasis on fintech and e-commerce sectors. Companies are increasingly adopting synthetic monitoring to enhance service delivery and operational efficiency.

France : France's Digital Transformation Journey

Key markets include Paris, Lyon, and Marseille, where tech startups and established firms thrive. The competitive landscape features players like Splunk and Catchpoint, which are gaining traction. The local market dynamics are characterized by a collaborative ecosystem, with a focus on sectors such as retail, finance, and healthcare. Businesses are increasingly leveraging synthetic monitoring to optimize user experiences and operational performance.

Russia : Russia's Expanding Digital Economy

Moscow and St. Petersburg are key markets, hosting a mix of tech companies and traditional industries. The competitive landscape includes local and international players, with a focus on adapting solutions to meet local needs. The business environment is evolving, with increasing investments in technology and a focus on sectors like telecommunications and e-commerce. Companies are adopting synthetic monitoring to improve service reliability and customer satisfaction.

Italy : Italy's Digital Growth Potential

Key markets include Milan, Rome, and Turin, where a mix of startups and established firms are present. The competitive landscape features players like Site24x7 and Uptrends, which are gaining market share. The local business environment is characterized by a focus on sectors such as retail, finance, and manufacturing. Companies are increasingly adopting synthetic monitoring to enhance operational efficiency and customer engagement.

Spain : Spain's Digital Transformation Efforts

Key markets include Madrid, Barcelona, and Valencia, where tech startups and established firms thrive. The competitive landscape features players like Dynatrace and New Relic, which are well-positioned to capture market share. The local business environment is dynamic, with a strong emphasis on sectors such as tourism, finance, and retail. Companies are increasingly adopting synthetic monitoring to optimize user experiences and operational performance.

Rest of Europe : Diverse Opportunities Across Europe

Countries like Belgium, Netherlands, and Switzerland are key markets, hosting a mix of tech companies and traditional industries. The competitive landscape includes local and international players, with a focus on adapting solutions to meet local needs. The business environment is evolving, with increasing investments in technology and a focus on sectors like finance and e-commerce. Companies are adopting synthetic monitoring to improve service reliability and customer satisfaction.