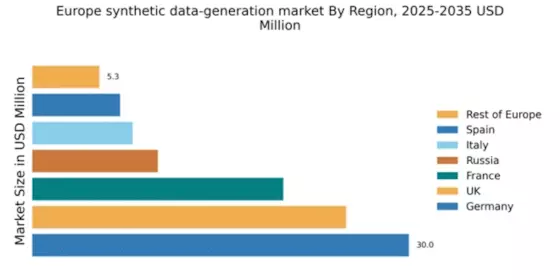

Germany : Innovation Drives Germany's Growth

Germany holds a commanding 30.0% market share in the synthetic data-generation sector, valued at approximately 1.5 billion USD. Key growth drivers include a robust tech ecosystem, significant investments in AI, and a strong focus on data privacy regulations. Demand is surging in sectors like automotive and healthcare, where synthetic data is crucial for training AI models while adhering to GDPR. Government initiatives promoting digital transformation further bolster market growth, supported by advanced infrastructure and a skilled workforce.

UK : UK's Tech Hub Fuels Demand

The UK commands a 25.0% market share in synthetic data generation, valued at around €1.25 billion. The growth is driven by a vibrant tech startup ecosystem, particularly in London and Cambridge, where AI and machine learning are rapidly evolving. Demand is increasing in finance and healthcare sectors, with companies seeking to enhance data privacy and compliance. The UK government supports innovation through funding initiatives and regulatory frameworks that encourage responsible data use, fostering a conducive environment for market expansion.

France : France's Strategic Investments Pay Off

France holds a 20.0% market share in the synthetic data market, valued at approximately €1 billion. The growth is fueled by strategic investments in AI and data science, particularly in Paris and Lyon. Demand trends indicate a rising need for synthetic data in sectors like retail and telecommunications, driven by the desire for enhanced customer insights while maintaining privacy. The French government actively promotes digital innovation through initiatives like the National AI Strategy, which supports research and development in synthetic data technologies.

Russia : Russia's Market Potential Unfolds

With a 10.0% market share, Russia's synthetic data market is valued at around €500 million. Key growth drivers include increasing investments in AI and machine learning, particularly in Moscow and St. Petersburg. Demand is emerging in sectors such as finance and telecommunications, where companies are exploring synthetic data for risk assessment and customer analytics. However, regulatory challenges and a developing infrastructure pose hurdles. The Russian government is beginning to recognize the importance of data innovation, which may lead to supportive policies in the future.

Italy : Innovation and Regulation in Italy

Italy captures an 8.0% market share in the synthetic data sector, valued at approximately €400 million. Growth is driven by increasing awareness of data privacy and the need for compliance with GDPR. Key markets include Milan and Rome, where demand for synthetic data is rising in sectors like fashion and automotive. The Italian government is implementing initiatives to support digital transformation, although the market faces challenges related to infrastructure and investment. Local players are beginning to emerge, enhancing competition in the landscape.

Spain : Emerging Trends in Synthetic Data

Spain holds a 7.0% market share in the synthetic data market, valued at around €350 million. The growth is driven by increasing adoption of AI technologies, particularly in Barcelona and Madrid. Demand is growing in sectors like tourism and finance, where synthetic data is used for customer insights and predictive analytics. The Spanish government is promoting digital innovation through various initiatives, although regulatory frameworks are still developing. Local startups are beginning to make their mark, contributing to a competitive environment.

Rest of Europe : Fragmented Growth Across Regions

The Rest of Europe accounts for a 5.34% market share in synthetic data generation, valued at approximately €267 million. Growth is uneven, with varying demand across countries like Belgium, Netherlands, and the Nordics. Key drivers include increasing awareness of data privacy and the need for compliance with regulations. Local initiatives are emerging to support digital transformation, although infrastructure challenges persist. The competitive landscape is characterized by a mix of local startups and established players, creating diverse opportunities for growth.