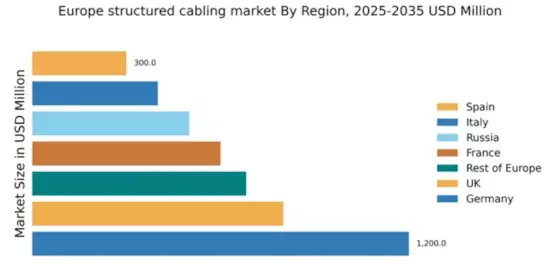

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant position in the European structured cabling market, accounting for 30% of the total market share with a value of $1,200.0 million. Key growth drivers include the rapid expansion of data centers, increased demand for high-speed internet, and government initiatives promoting digital infrastructure. Regulatory policies favoring technological advancements and sustainability are also pivotal, alongside significant investments in industrial development and smart city projects.

UK : Investment in Connectivity Fuels Demand

Key markets include London, Manchester, and Birmingham, where demand for structured cabling is surging. The competitive landscape features major players like CommScope and Belden, alongside local firms. The business environment is dynamic, with a focus on telecommunications, IT, and smart building applications.

France : Diverse Applications Drive Market Growth

Key markets include Paris, Lyon, and Marseille, where urban development projects are prominent. Major players like Legrand and Nexans have a strong presence, contributing to a competitive landscape. The local market is characterized by a focus on telecommunications, data centers, and industrial applications.

Russia : Infrastructure Development is Key

Moscow and St. Petersburg are key markets, with significant demand for structured cabling in commercial and industrial sectors. The competitive landscape includes both local and international players, with a focus on telecommunications and IT applications. The business environment is evolving, with increasing interest in smart city projects.

Italy : Focus on Innovation and Sustainability

Key markets include Milan, Rome, and Turin, where demand for structured cabling is growing in commercial and residential sectors. Major players like Panduit and TE Connectivity are active in the market, contributing to a competitive landscape. The local business environment is increasingly focused on telecommunications, data centers, and smart building applications.

Spain : Digital Transformation Drives Demand

Key markets include Madrid and Barcelona, where urban development and smart city initiatives are prominent. The competitive landscape features both local and international players, with a focus on telecommunications and IT sectors. The business environment is dynamic, with increasing investments in digital infrastructure.

Rest of Europe : Varied Growth Across Sub-regions

Key markets include the Nordic countries, Benelux, and Eastern Europe, each with unique demands and competitive landscapes. Major players like Corning and Schneider Electric have a presence, but local firms also play a crucial role. The business environment is influenced by sector-specific applications, including telecommunications, data centers, and industrial automation.