Rapid Industrialization and Infrastructure Development in Emerging Economies

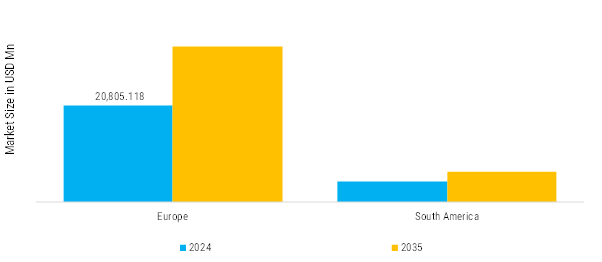

Rapid industrialization and infrastructure development in emerging economies are key drivers of growth in the low and medium voltage (LV and MV) switchgear market in both Europe and South America. As these regions expand their manufacturing bases, upgrade transportation systems, and invest in new energy, water, and communication networks, the demand for reliable and scalable power distribution systems has increased significantly. Switchgear plays a foundational role in these developments, as it ensures safe, efficient, and uninterrupted electricity supply critical for industrial operations, construction projects, and urban development. In Europe, emerging economies in Eastern and Central Europe such as Poland, Romania, and the Baltic states—are experiencing substantial growth due to increased foreign investment, EU infrastructure funding, and reshoring of manufacturing.

These developments require modern electrical infrastructure capable of supporting growing power demands in sectors like automotive, electronics, and construction. Medium voltage switchgear is particularly essential in industrial zones and large-scale infrastructure projects, where it ensures stability in high-load environments, protects equipment, and minimizes energy losses. Similarly, low voltage switchgear is vital for localized distribution in buildings, utilities, and commercial facilities. The European Union’s commitment to modernizing outdated grids and promoting smart infrastructure also drives adoption of advanced switchgear technologies with features such as real-time monitoring, automation, and predictive maintenance.

Growing Renewable Energy Projects and Their Need for Efficient Distribution Systems

The Renewable energy sources (RES) offer numerous societal advantages over fossil fuels, including helping to combat climate change, cutting down air pollution, and enhancing energy security. In recognition of these benefits, the European Union has raised its renewable energy targets under the revised Renewable Energy Directive. The new goal increases the minimum required share of renewables in the EU’s total energy consumption from 32% to at least 42.5%, with aspirations to reach 45%. Rather than assigning country-specific quotas, this collective target relies on all EU Member States contributing proportionally. As of 2023, the share of renewables in the EU’s energy mix reached 24.5%, marking a one percentage point increase from 2022 and setting a new record. This progress reflects the impact of strengthened EU climate policies, such as the "Fit-for-55" legislative package and the RepowerEU strategy, both of which gained urgency and political momentum in response to the energy crisis triggered by Russia’s invasion of Ukraine.

These frameworks are designed to accelerate the clean energy transition across Europe and reduce reliance on imported fossil fuels. The growing adoption of renewable energy projects in both Europe and South America is significantly driving the demand for medium and low voltage switchgear systems. As countries in these regions invest in wind, solar, and hydroelectric power, they are not only increasing their energy generation capacity but also facing the challenge of efficiently integrating and distributing this energy across diverse grids. Renewable energy sources, by nature, are often decentralized and can fluctuate in production due to weather conditions, making reliable and adaptable electrical distribution systems essential. Medium and low voltage switchgear plays a crucial role in this process by ensuring the safe and efficient distribution of electricity from renewable sources to consumers. These systems help manage the integration of variable energy outputs into the grid, ensuring stability and reducing the risk of overloads or failures.

Increasing Demand for Energy-Efficient Solutions in Residential and Commercial Sectors

Low voltage switchgear is a crucial component of any home's electrical infrastructure, serving as the first line of defense in managing electrical loads and protecting circuits from power surges and short circuits. Its primary function is to safeguard appliances and wiring from damage caused by excessive current, thereby preventing potential hazards such as electrical fires. In residential settings, where single-phase electricity is typically sufficient, low voltage switchgear ensures safe and controlled power distribution, effectively acting as the gatekeeper of the home’s electrical system. As power demands increase in larger environments such as commercial buildings and community complexes, the role of medium voltage switchgear becomes essential. These systems are designed to handle higher current levels while maintaining safety and performance under diverse environmental and operational conditions, including alternating current (AC) systems. Unlike residential setups, commercial and industrial spaces often require three-phase electricity to power heavy-duty equipment like elevators, HVAC systems, and large lighting arrays.

In such applications, medium voltage switchgear not only facilitates efficient power distribution but also ensures uninterrupted power supply, which is critical in facilities like hospitals where reliability is paramount. Moreover, medium voltage switchgear often incorporates more advanced insulation technologies. While vacuum-insulated switchgear is widely used, sulfur hexafluoride (SF6) insulated switchgear is preferred in commercial and high-voltage environments due to its superior voltage handling capabilities. However, SF6 is not typically used in residential systems, as the voltage requirements are significantly lower. Regardless of the setting, selecting the appropriate type of switchgear—whether for a household running basic appliances or a commercial complex with complex energy demands—is vital to ensure safety, reliability, and long-term performance of the electrical system.