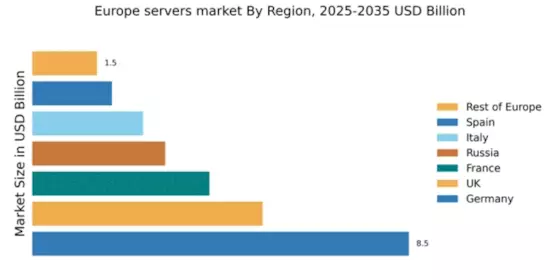

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding 8.5% market share in the European server market, valued at approximately €3.4 billion. Key growth drivers include the rapid digital transformation across industries, increased cloud adoption, and government initiatives promoting IT infrastructure. The demand for high-performance computing and data centers is surging, supported by favorable regulatory policies that encourage innovation and investment in technology.

UK : Innovation Fuels Server Demand Growth

The UK server market accounts for 5.2% of the European total, valued at around €2.1 billion. Growth is driven by the rise of e-commerce, remote working trends, and the increasing need for data security. Regulatory frameworks, such as GDPR, are shaping consumption patterns, pushing businesses to invest in compliant server solutions. The UK government also supports tech innovation through various funding programs.

France : Government Support Enhances Market Potential

France's server market represents 4.0% of the European landscape, valued at approximately €1.6 billion. Key growth drivers include the expansion of cloud services and the push for digital sovereignty. Government initiatives, such as the France 2030 plan, aim to bolster the tech sector, encouraging local production and innovation. The demand for energy-efficient servers is also on the rise, reflecting sustainability trends.

Russia : Local Demand Drives Server Investments

Russia holds a 3.0% share of the European server market, valued at about €1.2 billion. Growth is fueled by increasing local data center investments and a focus on domestic IT solutions. Regulatory policies, including data localization laws, are influencing consumption patterns, pushing businesses to invest in local server infrastructure. The market is characterized by a mix of local and international players.

Italy : Investment in Digital Transformation Accelerates

Italy's server market accounts for 2.5% of the European total, valued at approximately €1 billion. The growth is driven by the increasing adoption of cloud computing and digital services across various sectors. Government initiatives aimed at enhancing digital infrastructure are also pivotal. The demand for servers in sectors like finance and manufacturing is particularly strong, reflecting the country's industrial base.

Spain : Cloud Adoption Boosts Server Demand

Spain's server market represents 1.8% of the European market, valued at around €700 million. The growth is primarily driven by the rise of cloud services and digital transformation initiatives across industries. Government support for tech innovation and infrastructure development is fostering a favorable business environment. Key sectors include telecommunications and e-commerce, which are rapidly expanding their server needs.

Rest of Europe : Regional Dynamics Shape Server Landscape

The Rest of Europe accounts for 1.46% of the server market, valued at approximately €580 million. Growth varies significantly across countries, influenced by local economic conditions and regulatory environments. Emerging markets are increasingly investing in IT infrastructure, driven by digital transformation. The competitive landscape includes both local and international players, adapting to diverse market needs.