Regulatory Compliance

Regulatory compliance is increasingly influencing the DC Powered Servers Market. Governments and regulatory bodies are implementing stringent energy efficiency standards and sustainability mandates that require organizations to adopt greener technologies. This regulatory landscape is pushing companies to transition from traditional AC powered systems to more efficient DC powered servers. Compliance with these regulations not only helps organizations avoid penalties but also enhances their reputation as environmentally responsible entities. Market data suggests that companies that prioritize sustainability are likely to experience improved customer loyalty and brand value. As regulations continue to evolve, the demand for DC powered servers is expected to rise, as they align with the goals of energy efficiency and reduced carbon emissions.

Energy Efficiency Demand

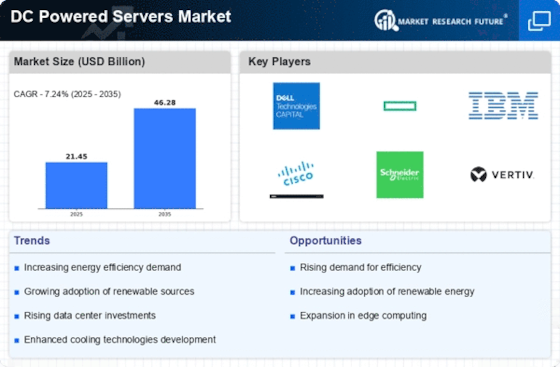

The increasing demand for energy efficiency is a primary driver in the DC Powered Servers Market. Organizations are increasingly seeking solutions that minimize energy consumption while maximizing performance. DC powered servers are known for their ability to reduce energy losses associated with AC to DC conversion, which can lead to significant cost savings. According to recent data, energy costs can account for a substantial portion of operational expenses in data centers. As a result, the adoption of DC powered servers is likely to rise, as they offer a more efficient alternative to traditional AC systems. This trend is further supported by regulatory pressures and corporate sustainability goals, which emphasize the need for greener technologies. Consequently, the focus on energy efficiency is expected to propel the growth of the DC Powered Servers Market.

Cost Reduction Strategies

Cost reduction strategies are a significant driver in the DC Powered Servers Market. Organizations are constantly seeking ways to lower operational costs while maintaining high performance levels. DC powered servers offer a compelling solution by reducing energy consumption and minimizing cooling requirements. This can lead to substantial savings in both energy bills and infrastructure costs. Market analysis indicates that companies can achieve up to 30% savings in energy costs by switching to DC powered systems. Additionally, the reduced need for complex power distribution systems can lower capital expenditures. As businesses continue to prioritize cost efficiency, the adoption of DC powered servers is likely to accelerate, further propelling the growth of the market.

Technological Innovations

Technological innovations play a crucial role in shaping the DC Powered Servers Market. Advances in server design, cooling technologies, and power management systems are enhancing the performance and reliability of DC powered servers. Innovations such as modular designs and improved thermal management are making these servers more appealing to enterprises looking to optimize their IT infrastructure. Furthermore, the integration of artificial intelligence and machine learning in server management is expected to streamline operations and improve energy efficiency. As these technologies continue to evolve, they are likely to drive further adoption of DC powered servers. The market is witnessing a shift towards more intelligent and adaptive systems, which could potentially redefine operational standards in data centers and other computing environments.

Increased Data Center Demand

The rapid expansion of data centers is a notable driver for the DC Powered Servers Market. With the proliferation of cloud computing, big data analytics, and the Internet of Things, the demand for data processing and storage capabilities has surged. This growth necessitates the deployment of more efficient server solutions, such as DC powered servers, which can handle higher loads with lower energy consumption. Market data indicates that the data center industry is projected to grow at a compound annual growth rate of over 10% in the coming years. As data centers strive to optimize their operations and reduce their carbon footprint, the shift towards DC powered servers is likely to gain momentum. This trend reflects a broader movement towards more sustainable and efficient infrastructure in the technology sector.