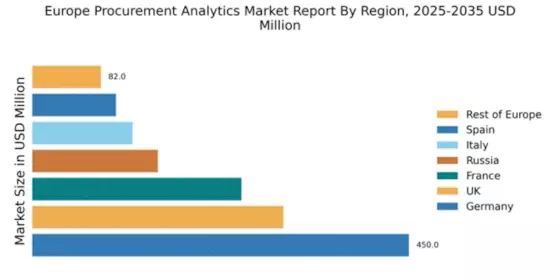

Germany : Strong Growth Driven by Innovation

Germany holds a dominant position in the European procurement analytics market, accounting for 450.0 million, representing 36.8% of the total market share. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and a strong focus on sustainability. Demand trends indicate a shift towards integrated solutions that enhance efficiency and transparency. Government initiatives promoting Industry 4.0 further bolster this growth, supported by advanced infrastructure and a skilled workforce.

UK : Innovation and Compliance Drive Growth

Key markets include London, Manchester, and Birmingham, where major players like SAP and Oracle have a significant presence. The competitive landscape is characterized by a mix of established firms and emerging startups, fostering innovation. Local dynamics emphasize the importance of sector-specific applications, particularly in finance and public services, creating a vibrant business environment.

France : Focus on Sustainability and Efficiency

Key markets include Paris, Lyon, and Marseille, where major players like SynerTrade and SAP are actively engaged. The competitive landscape features a blend of local and international firms, with a strong emphasis on innovation. The business environment is conducive to growth, particularly in sectors like retail and manufacturing, where procurement analytics can significantly enhance supply chain efficiency.

Russia : Investment in Technology and Infrastructure

Key cities such as Moscow and St. Petersburg are central to market activities, with major players like IBM and Oracle establishing a presence. The competitive landscape is evolving, with local firms beginning to innovate in response to market needs. The business environment is improving, particularly in sectors like energy and manufacturing, where procurement analytics can drive significant efficiencies.

Italy : Focus on Digital Transformation Initiatives

Key markets include Milan, Rome, and Turin, where major players like Coupa Software and SAP are making significant inroads. The competitive landscape is characterized by a mix of established firms and innovative startups. Local dynamics emphasize the importance of sector-specific applications, particularly in fashion and automotive, creating a vibrant business environment.

Spain : Innovation and Efficiency at Forefront

Key markets include Madrid and Barcelona, where major players like GEP Worldwide and Ivalua are establishing a strong presence. The competitive landscape is diverse, with both local and international firms vying for market share. The business environment is supportive of innovation, particularly in sectors like tourism and retail, where procurement analytics can significantly enhance operational performance.

Rest of Europe : Varied Growth Across Sub-regions

Key markets include countries like Belgium, Netherlands, and the Nordics, where local players are increasingly competing with global firms. The competitive landscape is characterized by a mix of established companies and emerging startups. Local dynamics emphasize the importance of sector-specific applications, particularly in logistics and healthcare, creating unique business environments.