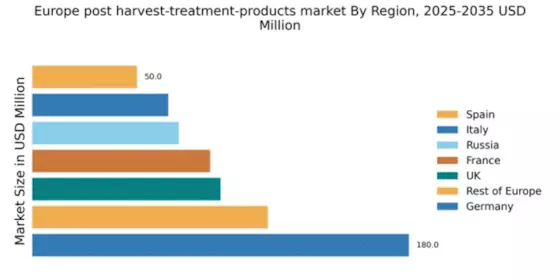

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant market share of 36% in the European post-harvest treatment products sector, valued at $180.0 Million. Key growth drivers include a robust agricultural sector, increasing demand for sustainable farming practices, and government initiatives promoting eco-friendly treatments. Regulatory policies are stringent, ensuring product safety and efficacy, which fosters consumer trust. The country’s advanced infrastructure supports efficient distribution and innovation in agricultural technologies.

UK : Sustainable Practices Shape Demand Trends

The UK accounts for 18% of the European market, valued at $90.0 million. Growth is driven by increasing consumer awareness of food safety and sustainability, alongside government support for innovative agricultural practices. Demand for post-harvest treatments is rising, particularly in regions like East Anglia and the Midlands, where intensive farming is prevalent. Regulatory frameworks are evolving to support sustainable practices, enhancing market dynamics.

France : Innovation and Tradition Coexist

France holds a market share of 17% in the post-harvest treatment sector, valued at $85.0 million. The growth is fueled by a blend of traditional farming practices and modern innovations, particularly in regions like Aquitaine and Provence. Government initiatives focus on reducing chemical usage, promoting organic treatments. The competitive landscape features major players like BASF and Syngenta, ensuring a diverse range of products tailored to local needs.

Russia : Market Potential in Agricultural Expansion

Russia represents 14% of the European market, valued at $70.0 million. The growth is driven by increasing agricultural production and a shift towards modern farming techniques. Key regions include Krasnodar and Tatarstan, where post-harvest treatments are gaining traction. However, regulatory challenges and infrastructure gaps remain. Major players like FMC and UPL are expanding their presence, adapting to local market dynamics and consumer preferences.

Italy : Cultural Heritage Influences Practices

Italy accounts for 13% of the market, valued at $65.0 million. The growth is supported by a rich agricultural heritage and a focus on quality produce, particularly in regions like Emilia-Romagna and Tuscany. Demand for post-harvest treatments is influenced by local preferences for organic and traditional methods. The competitive landscape includes key players like Bayer and ADAMA, who cater to diverse agricultural needs across the country.

Spain : Innovation Drives Competitive Edge

Spain holds a market share of 10% in the post-harvest treatment sector, valued at $50.0 million. The growth is driven by a strong export market, particularly in fruits and vegetables, with key regions like Andalusia leading the way. Government initiatives support innovation and sustainability, enhancing the business environment. Major players like Nufarm and Syngenta are actively involved, adapting to local market demands and trends.

Rest of Europe : Diverse Needs Across Multiple Regions

The Rest of Europe accounts for 22% of the market, valued at $112.5 million. This segment includes a mix of developed and developing markets, each with unique demands and regulatory environments. Growth drivers vary widely, influenced by local agricultural practices and government policies. Key players like UPL and FMC are expanding their reach, addressing diverse needs across countries such as Belgium, Netherlands, and Scandinavia.

Leave a Comment