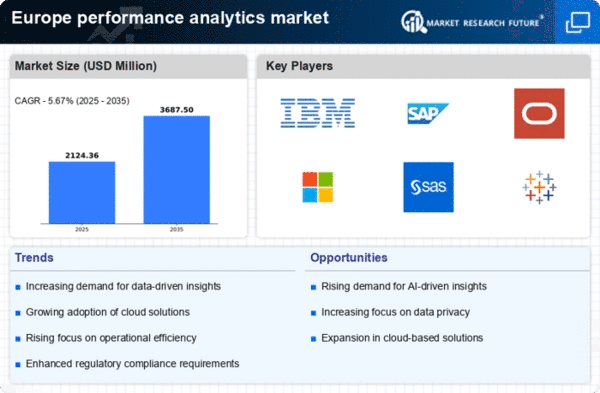

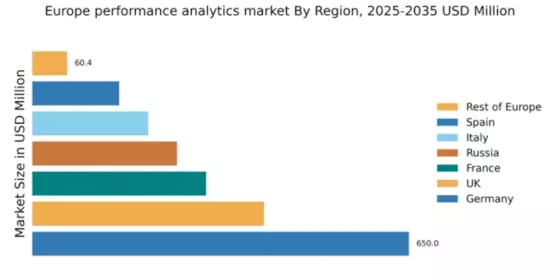

Germany : Strong Growth Driven by Innovation

Germany holds a commanding market share of 650.0 million, representing approximately 36.5% of the European performance analytics market. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and a strong emphasis on data-driven decision-making. Government policies promoting innovation and technology adoption further bolster demand, while advanced infrastructure supports seamless integration of analytics solutions.

UK : Innovation and Investment at Forefront

Key markets include London, Manchester, and Birmingham, where a vibrant tech ecosystem thrives. Major players like IBM and Microsoft have a significant presence, fostering a competitive landscape. The local business environment is characterized by a strong focus on fintech and e-commerce sectors, which increasingly rely on performance analytics for strategic decision-making.

France : Growth Driven by Diverse Industries

Key cities like Paris, Lyon, and Marseille are central to the analytics market, hosting numerous tech startups and established firms. The competitive landscape features major players such as SAP and Oracle, which cater to diverse industries including retail, healthcare, and finance. The local market dynamics are favorable, with businesses increasingly leveraging analytics for operational efficiency and customer insights.

Russia : Market Expansion Amid Challenges

Moscow and St. Petersburg are key markets, with a growing number of tech companies and startups focusing on analytics. The competitive landscape includes both local and international players, with firms like SAS and Tableau establishing a presence. The business environment is evolving, with sectors such as telecommunications and energy increasingly adopting performance analytics for strategic advantages.

Italy : Focus on Digital Transformation

Key markets include Milan, Rome, and Turin, where a mix of traditional and tech-driven industries thrive. Major players like IBM and Microsoft are actively engaged in the market, contributing to a competitive landscape. The local business environment is characterized by a strong focus on manufacturing and retail sectors, which are increasingly leveraging analytics for operational efficiency and customer engagement.

Spain : Strategic Growth in Key Sectors

Key cities like Madrid and Barcelona are central to the analytics market, hosting numerous tech firms and startups. The competitive landscape features major players such as Qlik and MicroStrategy, which cater to various industries. The local market dynamics are favorable, with businesses increasingly adopting analytics for strategic insights and operational improvements.

Rest of Europe : Varied Growth Across Regions

Key markets include smaller nations like Belgium, Netherlands, and the Nordic countries, where local players and international firms compete. The competitive landscape is diverse, with varying levels of market maturity. Industries such as logistics and manufacturing are increasingly leveraging analytics for efficiency and competitive advantage, adapting to local market dynamics.