Regulatory Compliance Pressure

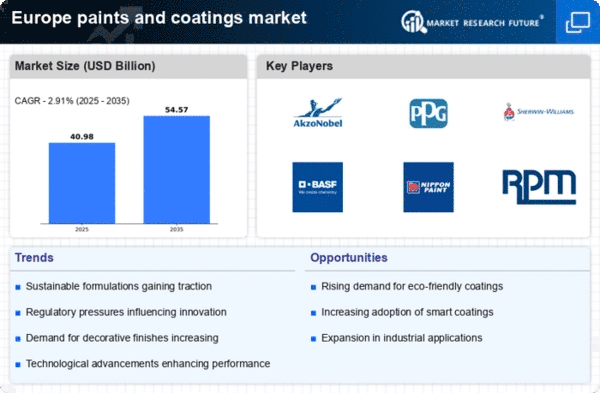

The paints coatings market in Europe is increasingly influenced by stringent regulatory frameworks aimed at reducing environmental impact. Regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and VOC (Volatile Organic Compounds) limits compel manufacturers to innovate and reformulate products. This compliance pressure drives the demand for eco-friendly and low-VOC coatings, which are projected to capture a larger market share. As of 2025, the market for low-VOC paints is expected to grow by approximately 15%, reflecting a shift towards sustainable practices. Consequently, companies that adapt to these regulations are likely to gain a competitive edge in the paints coatings market.

Growth of the Automotive Sector

The automotive industry in Europe is experiencing a resurgence, which significantly influences the paints coatings market. As vehicle production ramps up, the demand for high-performance coatings that provide durability, corrosion resistance, and aesthetic appeal is on the rise. The automotive coatings segment is projected to account for over 25% of the total paints coatings market by 2025. This growth is driven by the increasing focus on vehicle customization and the need for protective coatings that can withstand various environmental challenges. Consequently, the paints coatings market is likely to benefit from the automotive sector's expansion, leading to increased sales and innovation.

Consumer Preference for Aesthetics

In Europe, there is a notable shift in consumer preferences towards aesthetically pleasing and customizable coatings. This trend is particularly evident in the residential sector, where homeowners seek unique colors and finishes to enhance their living spaces. The paints coatings market is responding to this demand by offering a wider range of decorative coatings, including textured and specialty finishes. Market data indicates that decorative coatings account for approximately 30% of the total market share in 2025, reflecting a growing inclination towards personalization. This consumer-driven demand for aesthetics is likely to propel innovation and diversification within the paints coatings market.

Urbanization and Infrastructure Development

Urbanization in Europe continues to accelerate, leading to increased demand for residential and commercial construction. This trend significantly impacts the paints coatings market, as new buildings require high-quality coatings for aesthetic and protective purposes. The European construction sector is projected to grow at a CAGR of 4% from 2025 to 2030, which will likely boost the demand for various types of coatings. Additionally, infrastructure projects, including roads and bridges, necessitate durable coatings that can withstand harsh environmental conditions. As a result, the paints coatings market is poised for growth, driven by urban expansion and infrastructure investments.

Technological Innovations in Coating Applications

Technological advancements in application techniques are transforming the paints coatings market in Europe. Innovations such as spray technology, electrostatic application, and advanced curing methods enhance the efficiency and effectiveness of coatings. These technologies not only improve application speed but also reduce waste and environmental impact. As a result, manufacturers are increasingly adopting these advanced techniques to meet the evolving needs of consumers and industries. The market for technologically advanced coatings is expected to grow by 10% annually, indicating a strong trend towards efficiency and sustainability in the paints coatings market.