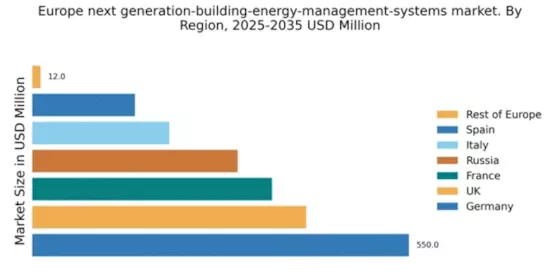

Germany : Strong Infrastructure and Innovation Hub

Key markets include major cities like Berlin, Munich, and Frankfurt, where the demand for advanced energy management systems is particularly high. The competitive landscape features significant players such as Siemens and Schneider Electric, who are actively innovating in this space. Local dynamics favor a collaborative approach between government and industry, fostering a business environment ripe for technological advancements. The industrial sector, particularly manufacturing and logistics, is a primary application area for these systems.

UK : Innovative Market with Regulatory Support

Key markets include London, Manchester, and Birmingham, where urbanization and commercial activities drive demand. The competitive landscape features major players like Johnson Controls and Honeywell, who are leveraging innovative technologies to capture market share. The business environment is characterized by a strong focus on sustainability, with sectors such as retail and healthcare increasingly adopting energy management solutions to optimize operations and reduce costs.

France : Regulatory Frameworks Driving Innovation

Key markets include Paris, Lyon, and Marseille, where urban development and sustainability initiatives are prominent. The competitive landscape features players like Schneider Electric and Trane Technologies, who are investing in smart technologies. The local business environment is conducive to innovation, with a focus on energy efficiency in sectors such as real estate and manufacturing, driving the adoption of advanced energy management systems.

Russia : Industrial Growth Fuels Demand

Key markets include Moscow and St. Petersburg, where industrial activities are concentrated. The competitive landscape is evolving, with players like Siemens and ABB establishing a presence. Local dynamics are influenced by a mix of state-owned and private enterprises, creating a unique business environment. The industrial sector, particularly oil and gas, is a significant application area for energy management systems, driving demand for innovative solutions.

Italy : Focus on Sustainability and Efficiency

Key markets include Milan, Rome, and Turin, where urbanization and sustainability initiatives are prominent. The competitive landscape features players like Honeywell and Johnson Controls, who are actively investing in innovative solutions. The local business environment is characterized by a strong focus on energy efficiency, with sectors such as hospitality and retail increasingly adopting energy management systems to enhance operational efficiency.

Spain : Investment in Smart Technologies

Key markets include Madrid and Barcelona, where urban development and sustainability initiatives are prominent. The competitive landscape features players like Trane Technologies and Siemens, who are leveraging innovative technologies to capture market share. The local business environment is supportive of energy efficiency initiatives, with sectors such as tourism and real estate increasingly adopting advanced energy management solutions.

Rest of Europe : Varied Growth Across Regions

Key markets include various countries such as Belgium, Netherlands, and Austria, each with distinct market dynamics. The competitive landscape is fragmented, with local and international players vying for market share. The business environment is influenced by varying regulatory frameworks, creating unique challenges and opportunities for energy management solutions across different sectors, including commercial and industrial applications.