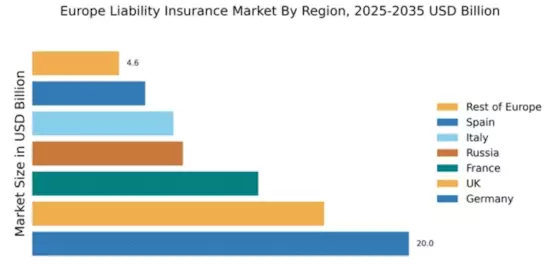

Germany : Strong Growth and Regulatory Support

Germany holds a commanding 20.0% share of the European liability insurance market, valued at approximately €8 billion. Key growth drivers include a robust industrial base, increasing regulatory requirements, and a rising awareness of liability risks among businesses. Demand trends indicate a shift towards comprehensive coverage solutions, driven by digital transformation and evolving business models. Government initiatives promoting risk management and compliance further bolster market growth, alongside significant investments in infrastructure development.

UK : Evolving Regulations and Consumer Demand

The UK liability insurance market accounts for 15.5% of the European total, valued at around €6.2 billion. Growth is fueled by increasing litigation rates and a heightened focus on corporate governance. Demand for tailored insurance products is rising, particularly in sectors like technology and healthcare. Regulatory changes, including the implementation of the Insurance Act 2015, have reshaped the landscape, encouraging transparency and fair treatment of policyholders.

France : Strong Regulatory Framework and Innovation

France represents 12.0% of the European liability insurance market, with a value of approximately €4.8 billion. The market is driven by stringent regulatory requirements and a growing emphasis on corporate social responsibility. Demand for liability insurance is increasing in sectors such as construction and manufacturing, where compliance with safety standards is critical. Government initiatives aimed at promoting sustainable business practices are also influencing market dynamics.

Russia : Regulatory Changes and Market Growth

Russia's liability insurance market holds an 8.0% share of the European landscape, valued at about €3.2 billion. Key growth drivers include regulatory reforms aimed at enhancing consumer protection and increasing awareness of liability risks among businesses. Demand is particularly strong in urban centers like Moscow and St. Petersburg, where industrial activities are concentrated. The competitive landscape features both local and international players, with a focus on adapting products to meet local needs.

Italy : Market Resilience and Regulatory Support

Italy accounts for 7.5% of the European liability insurance market, valued at approximately €3 billion. Growth is supported by a recovering economy and increasing demand for comprehensive coverage solutions. Regulatory frameworks are evolving, with a focus on enhancing consumer rights and promoting fair practices. Key sectors driving demand include tourism and manufacturing, particularly in regions like Lombardy and Emilia-Romagna, where industrial activity is robust.

Spain : Market Expansion and Regulatory Changes

Spain's liability insurance market represents 6.0% of the European total, valued at around €2.4 billion. The market is experiencing growth due to rising awareness of liability risks and the need for businesses to comply with regulatory standards. Key sectors include tourism and agriculture, with significant demand in regions like Catalonia and Andalusia. The competitive landscape features both domestic and international insurers, adapting to local market needs and preferences.

Rest of Europe : Varied Growth Across Sub-regions

The Rest of Europe accounts for 4.61% of the liability insurance market, valued at approximately €1.8 billion. This segment includes a mix of emerging and established markets, each with unique growth drivers. Demand trends vary significantly, influenced by local regulations and economic conditions. Countries like the Netherlands and Belgium are seeing increased demand for liability coverage, driven by industrial growth and regulatory compliance. The competitive landscape is characterized by a mix of local and international players, each tailoring products to meet specific regional needs.