Evolving Legal Frameworks

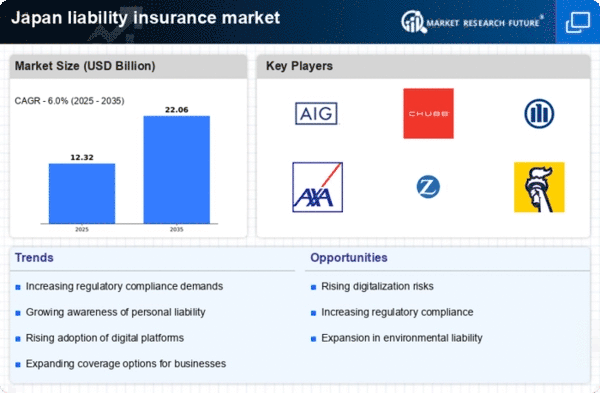

The evolution of legal frameworks in Japan is likely to have a profound impact on the liability insurance market. Recent reforms in tort law and consumer protection legislation have increased the potential for liability claims, compelling businesses to reassess their insurance needs. As the legal landscape becomes more complex, companies may find themselves exposed to new types of liabilities, necessitating comprehensive coverage. The liability insurance market is responding by developing innovative products that cater to these emerging legal challenges. In 2025, it is estimated that the market will see a 6% increase in demand for policies that cover new legal liabilities, reflecting the ongoing changes in the regulatory environment.

Rising Awareness of Liability Risks

The increasing awareness of liability risks among businesses and individuals in Japan appears to be a significant driver for the liability insurance market. As incidents of negligence and accidents become more publicized, organizations are recognizing the potential financial repercussions of such events. This heightened awareness is leading to a greater demand for liability insurance products, as companies seek to protect themselves from lawsuits and claims. In 2025, the market is projected to grow by approximately 5.5%, reflecting this trend. Furthermore, the liability insurance market is adapting to these changes by offering more tailored policies that address specific risks faced by various sectors, including construction and healthcare.

Focus on Corporate Governance and Compliance

The emphasis on corporate governance and compliance in Japan is shaping the liability insurance market. Companies are increasingly held accountable for their actions, leading to a greater focus on risk management practices. This shift is driving demand for liability insurance products that cover directors and officers, as well as general liability. The liability insurance market is responding by offering specialized policies that address the unique needs of corporations in this evolving landscape. In 2025, it is anticipated that the market will grow by approximately 4.5%, reflecting the heightened importance of compliance and governance in corporate strategies.

Technological Advancements in Risk Assessment

Technological advancements in risk assessment tools are transforming the liability insurance market in Japan. The integration of big data analytics and artificial intelligence allows insurers to evaluate risks more accurately and efficiently. This innovation not only enhances underwriting processes but also enables the liability insurance market to offer more competitive pricing and customized coverage options. As businesses increasingly rely on technology to manage risks, the demand for liability insurance products that incorporate these advancements is expected to rise. By 2025, the market could experience a growth rate of around 7%, driven by the adoption of these cutting-edge technologies in risk management.

Increased Business Activity and Entrepreneurship

The surge in business activity and entrepreneurship in Japan is contributing to the growth of the liability insurance market. As new startups and small businesses emerge, the need for liability coverage becomes more pronounced. Entrepreneurs are becoming more aware of the potential risks associated with their ventures, prompting them to seek insurance solutions that protect against various liabilities. The liability insurance market is likely to see a 5% increase in policy uptake among small businesses in 2025, as these entities recognize the importance of safeguarding their operations. This trend indicates a shift towards a more risk-aware business culture in Japan.