Rising Demand for Automation

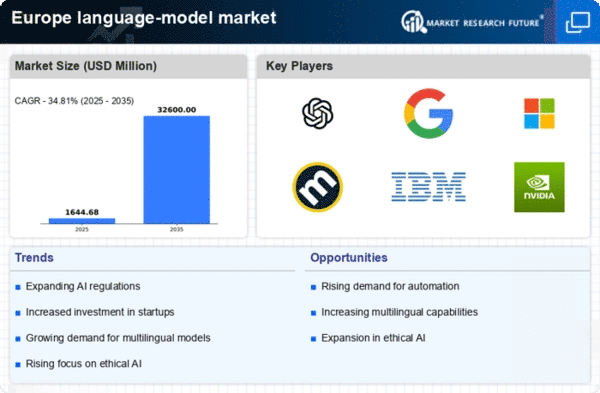

The large language-model market in Europe is experiencing a notable surge in demand for automation across various sectors. Businesses are increasingly recognizing the potential of these models to streamline operations, enhance productivity, and reduce costs. For instance, the integration of language models in customer service has shown to improve response times by up to 30%, thereby enhancing customer satisfaction. This trend is likely to continue as organizations seek to leverage advanced technologies to remain competitive. The European market is projected to grow at a CAGR of 25% from 2025 to 2030, driven by the need for efficient solutions that can handle large volumes of data and interactions. Consequently, the rising demand for automation is a pivotal driver in the large language-model market.

Growing Need for Enhanced Data Privacy

The increasing focus on data privacy regulations in Europe is significantly influencing the large language-model market. With the implementation of stringent laws such as the General Data Protection Regulation (GDPR), companies are compelled to adopt language models that prioritize user privacy and data security. This regulatory environment is driving innovation in the development of privacy-preserving models, which can process data without compromising individual privacy. As organizations strive to comply with these regulations, the demand for compliant language models is expected to rise. In 2025, it is projected that 60% of companies in Europe will prioritize data privacy in their AI strategies, thereby propelling growth in the large language-model market. This trend underscores the importance of aligning technological advancements with regulatory requirements.

Investment in AI Research and Development

Investment in artificial intelligence research and development is a critical driver for the large language-model market in Europe. Governments and private entities are allocating substantial funds to foster innovation in AI technologies. In 2025, it is estimated that AI-related investments in Europe will reach approximately €20 billion, reflecting a growing commitment to advancing language models. This influx of capital is expected to accelerate the development of more sophisticated models, enhancing their capabilities and applications. Furthermore, collaboration between academia and industry is likely to yield breakthroughs that could redefine the landscape of the large language-model market. As a result, the emphasis on R&D is anticipated to play a significant role in shaping the future of language models in Europe.

Increased Focus on Multimodal Applications

The large language-model market in Europe is witnessing an increased focus on multimodal applications, which integrate text, audio, and visual data. This trend is driven by the growing recognition of the need for models that can understand and generate content across various formats. As businesses seek to enhance user engagement and experience, the demand for multimodal capabilities is expected to rise. In 2025, it is projected that the market for multimodal AI applications will grow by 35%, reflecting a shift towards more versatile and comprehensive solutions. This evolution is likely to lead to the development of more sophisticated language models that can cater to diverse user needs. Thus, the emphasis on multimodal applications serves as a significant driver in the large language-model market.

Expansion of Cloud Computing Infrastructure

The expansion of cloud computing infrastructure across Europe is facilitating the growth of the large language-model market. As more businesses migrate to cloud-based solutions, the accessibility and scalability of language models are significantly enhanced. This shift allows organizations to leverage powerful language models without the need for extensive on-premises hardware investments. In 2025, it is estimated that cloud services will account for over 40% of the total IT spending in Europe, indicating a robust trend towards cloud adoption. This transition is likely to enable smaller enterprises to utilize advanced language models, thereby democratizing access to AI technologies. Consequently, the expansion of cloud infrastructure is a vital driver in the large language-model market, fostering innovation and accessibility.