Germany : Innovation and Growth in Germany

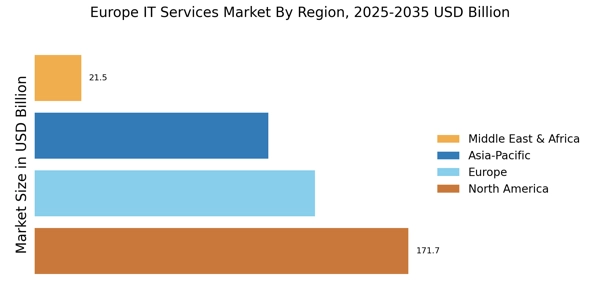

Germany holds a commanding market share of 130.0, representing a significant portion of Europe's IT services sector. Key growth drivers include a robust industrial base, increasing digital transformation initiatives, and strong government support for technology adoption. Demand trends indicate a shift towards cloud computing and cybersecurity services, driven by regulatory policies promoting data protection and digital infrastructure development. The government’s Industry 4.0 initiative further enhances the market landscape, fostering innovation and investment in technology.

Key markets within Germany include major cities like Berlin, Munich, and Frankfurt, which are hubs for IT services and innovation. The competitive landscape features prominent players such as SAP, IBM, and Accenture, all vying for market share. Local dynamics are characterized by a strong emphasis on quality and reliability, with businesses increasingly adopting IT solutions to enhance operational efficiency. Sectors like automotive, finance, and healthcare are particularly active in leveraging IT services for digital transformation.

UK : Innovation Driving UK Market Growth

The UK IT services market is valued at 100.0, showcasing a diverse and rapidly evolving landscape. Key growth drivers include the rise of fintech, e-commerce, and a strong push towards digital transformation across various sectors. Demand for IT services is increasingly influenced by consumer behavior shifts towards online services, alongside government initiatives aimed at enhancing digital skills and infrastructure. Regulatory frameworks, such as GDPR, also play a crucial role in shaping market dynamics.

London, Manchester, and Edinburgh are key markets, with a competitive environment featuring major players like IBM, TCS, and Capgemini. The UK market is characterized by a vibrant startup ecosystem, particularly in technology and digital services. Local businesses are increasingly adopting cloud solutions and cybersecurity measures, reflecting a growing awareness of the importance of digital resilience in a post-pandemic world.

France : France's Digital Transformation Journey

France's IT services market is valued at 80.0, driven by a strong emphasis on digital transformation across industries. Key growth drivers include government initiatives like the France 2030 plan, which aims to boost innovation and technology adoption. Demand trends show a significant increase in cloud services and AI applications, supported by regulatory policies that encourage digital investment. The French government is also focused on enhancing cybersecurity measures, further propelling market growth.

Key markets include Paris, Lyon, and Toulouse, where major players like Capgemini and Atos have a strong presence. The competitive landscape is marked by a mix of established firms and innovative startups, fostering a dynamic business environment. Sectors such as aerospace, automotive, and healthcare are particularly active in adopting IT services, reflecting the country's commitment to leveraging technology for economic growth.

Russia : Growth Amidst Challenges in Russia

Russia's IT services market is valued at 50.0, showing potential for growth despite economic challenges. Key growth drivers include increasing demand for digital solutions in various sectors, particularly in government and finance. The market is influenced by regulatory policies aimed at promoting local IT development and reducing dependency on foreign technologies. Additionally, the push for digitalization in public services is driving demand for IT services.

Moscow and St. Petersburg are key markets, with a competitive landscape featuring local players and some international firms. Major players like TCS and IBM are present, but local companies are gaining traction. The business environment is characterized by a focus on innovation and adaptation to local needs, with sectors like e-commerce and telecommunications actively seeking IT solutions to enhance efficiency and service delivery.

Italy : Italy's Digital Evolution

Italy's IT services market is valued at 40.0, reflecting a growing demand for digital solutions across various sectors. Key growth drivers include government initiatives aimed at fostering digital transformation, such as the National Plan for Recovery and Resilience. Demand trends indicate a shift towards cloud computing and e-commerce solutions, supported by regulatory frameworks that encourage innovation and investment in technology.

Key markets include Milan, Rome, and Turin, where major players like IBM and Accenture are actively competing. The competitive landscape is characterized by a mix of established firms and emerging startups, creating a dynamic business environment. Sectors such as retail, manufacturing, and finance are particularly focused on leveraging IT services to enhance operational efficiency and customer engagement.

Spain : Spain's Digital Transformation Journey

Spain's IT services market is valued at 30.0, showcasing a growing appetite for digital solutions across various industries. Key growth drivers include government initiatives aimed at enhancing digital skills and infrastructure, alongside increasing demand for cloud services and cybersecurity. Regulatory policies are also evolving to support digital transformation, creating a favorable environment for IT service providers.

Key markets include Madrid, Barcelona, and Valencia, where major players like Accenture and Fujitsu have established a strong presence. The competitive landscape is marked by a mix of local and international firms, fostering innovation and collaboration. Sectors such as tourism, finance, and healthcare are particularly active in adopting IT services, reflecting Spain's commitment to leveraging technology for economic growth.

Rest of Europe : Emerging Markets in Europe

The Rest of Europe IT services market is valued at 46.0, encompassing a diverse range of countries with varying levels of digital maturity. Key growth drivers include increasing demand for IT solutions in sectors like healthcare, finance, and manufacturing. Regulatory policies across different countries are evolving to support digital transformation, creating opportunities for IT service providers. Infrastructure development is also a focus, with investments aimed at enhancing connectivity and technology adoption.

Key markets include cities in countries like Belgium, Netherlands, and the Nordics, where major players like SAP and Oracle are actively competing. The competitive landscape is characterized by a mix of local firms and international players, fostering a dynamic business environment. Local market dynamics vary, with some countries experiencing rapid digital growth while others are still in the early stages of transformation, creating a unique landscape for IT services.