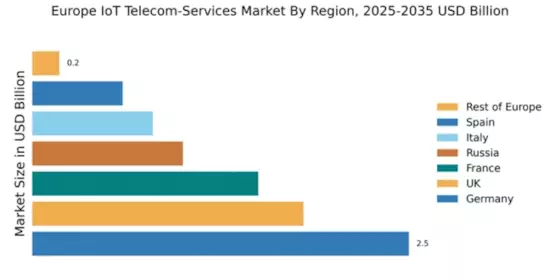

Germany : Strong Infrastructure and Innovation Hub

Key markets include cities like Berlin, Munich, and Frankfurt, which are pivotal for IoT innovation. The competitive landscape features major players such as Deutsche Telekom and Vodafone, who are investing heavily in IoT solutions. The local business environment is characterized by a strong focus on R&D, with applications spanning automotive, healthcare, and smart cities. The integration of IoT in manufacturing processes is particularly noteworthy, enhancing efficiency and productivity.

UK : Innovation and Investment Driving Demand

London, Manchester, and Birmingham are key markets for IoT services, with a competitive landscape featuring major players like Vodafone and BT Group. The local market dynamics are characterized by a strong startup culture, fostering innovation in sectors such as healthcare, transportation, and smart cities. The UK government’s focus on creating a digital economy is further enhancing the business environment for IoT applications.

France : Government Support and Innovation Focus

Key markets include Paris, Lyon, and Marseille, where major players like Orange and Bouygues Telecom are actively expanding their IoT offerings. The competitive landscape is marked by a mix of established telecom operators and innovative startups. Local market dynamics are favorable, with a focus on applications in transportation, energy management, and urban development, enhancing the overall business environment for IoT services.

Russia : Market Expansion and Investment Opportunities

Moscow and St. Petersburg are key markets, with major players like MTS and MegaFon leading the competitive landscape. The local business environment is evolving, with a growing focus on IoT applications in smart agriculture and energy efficiency. The Russian government’s commitment to digital transformation is fostering a conducive environment for IoT market expansion, attracting both local and international investments.

Italy : Focus on Smart Solutions and Connectivity

Key markets include Milan, Rome, and Turin, where major players like Telecom Italia and Vodafone are expanding their IoT offerings. The competitive landscape is characterized by a mix of established telecom operators and emerging startups. Local market dynamics are favorable, with applications in smart cities, healthcare, and logistics gaining traction, enhancing the overall business environment for IoT services.

Spain : Investment and Innovation Driving Growth

Key markets include Madrid, Barcelona, and Valencia, where major players like Telefónica and Orange are actively expanding their IoT services. The competitive landscape features a mix of established telecom operators and innovative startups. Local market dynamics are characterized by a strong focus on applications in smart cities, agriculture, and energy management, enhancing the overall business environment for IoT services.

Rest of Europe : Varied Opportunities Across Regions

Key markets include countries like Belgium, Netherlands, and the Nordic regions, where major players like Vodafone and Orange are expanding their presence. The competitive landscape is diverse, with a mix of established telecom operators and local startups. Local market dynamics are influenced by sector-specific applications in logistics, healthcare, and smart energy solutions, creating unique opportunities for IoT services.

Leave a Comment