Rising Demand for Automation

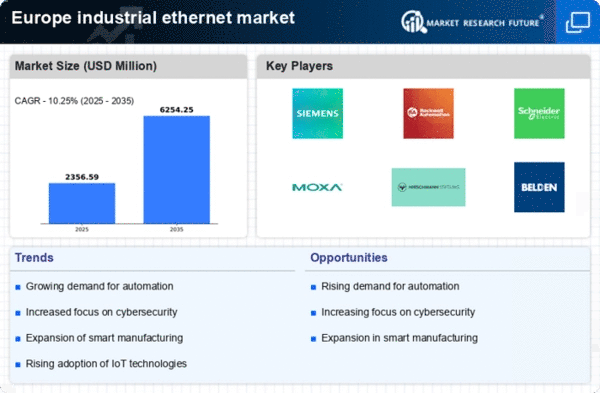

The industrial ethernet market in Europe is experiencing a notable surge in demand for automation technologies. As industries strive for enhanced efficiency and productivity, the integration of industrial ethernet solutions becomes increasingly vital. Automation facilitates real-time data exchange and control, which is essential for modern manufacturing processes. According to recent data, the automation sector is projected to grow at a CAGR of approximately 8% over the next five years. This growth directly influences the industrial ethernet market, as companies seek reliable and high-speed communication networks to support automated systems. Furthermore, the push towards Industry 4.0 initiatives emphasizes the need for robust networking solutions, thereby driving the adoption of industrial ethernet technologies across various sectors.

Expansion of Smart Manufacturing

The industrial ethernet market in Europe is significantly impacted by the expansion of smart manufacturing practices. As manufacturers increasingly adopt smart technologies, the need for seamless connectivity and data sharing becomes paramount. Smart manufacturing relies on interconnected devices and systems, which necessitate the deployment of advanced industrial ethernet solutions. Recent statistics indicate that the smart manufacturing market is expected to reach €200 billion by 2026, with a substantial portion attributed to networking technologies. This trend suggests that the industrial ethernet market will continue to grow as manufacturers invest in infrastructure that supports real-time monitoring, predictive maintenance, and data analytics. The integration of industrial ethernet solutions is thus essential for achieving the operational efficiencies associated with smart manufacturing.

Increased Focus on Data Security

The industrial ethernet market in Europe is increasingly influenced by a heightened focus on data security. As industries become more interconnected, the risk of cyber threats escalates, prompting organizations to prioritize secure networking solutions. The implementation of industrial ethernet technologies is seen as a critical measure to safeguard sensitive data and ensure operational continuity. Recent reports indicate that cyberattacks on industrial systems have risen by 30% in the past year, underscoring the urgency for robust security measures. Consequently, the demand for industrial ethernet solutions that incorporate advanced security features is likely to grow, as companies seek to protect their assets and maintain compliance with evolving regulations.

Growth in Industrial IoT Applications

The industrial ethernet market in Europe is poised for growth due to the increasing implementation of Industrial Internet of Things (IIoT) applications. IIoT enables the interconnection of devices and systems, allowing for enhanced data collection and analysis. This trend is particularly relevant in sectors such as manufacturing, energy, and transportation, where real-time data is crucial for decision-making. The IIoT market is projected to grow at a CAGR of 10% through 2027, indicating a robust demand for reliable networking solutions. As companies seek to leverage IIoT capabilities, the industrial ethernet market is likely to benefit from the need for high-speed, low-latency communication networks that can support a multitude of connected devices and applications.

Investment in Infrastructure Development

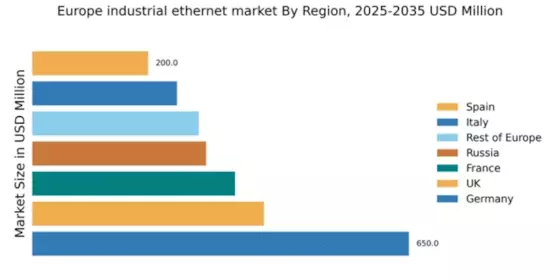

The industrial ethernet market in Europe is benefiting from substantial investments in infrastructure development. Governments and private sectors are increasingly recognizing the importance of modernizing communication networks to support advanced manufacturing and industrial processes. Recent initiatives indicate that over €50 billion is allocated for infrastructure upgrades across various European countries, aimed at enhancing connectivity and supporting digital transformation. This investment is expected to bolster the industrial ethernet market, as companies require reliable and high-performance networking solutions to facilitate their operations. The emphasis on infrastructure development aligns with broader economic goals, suggesting a sustained demand for industrial ethernet technologies in the coming years.