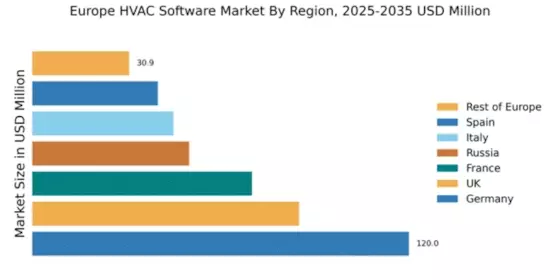

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 120.0, representing a significant portion of the European HVAC software market. Key growth drivers include a robust industrial base, increasing energy efficiency regulations, and a strong push towards smart building technologies. The demand for HVAC solutions is rising, driven by urbanization and a focus on sustainable practices. Government initiatives, such as the Energy Efficiency Strategy 2050, further bolster this growth by promoting energy-efficient technologies and infrastructure development.

UK : Sustainability and Innovation at Forefront

The UK HVAC software market is valued at 85.0, reflecting a growing trend towards sustainable building practices. Key growth drivers include government incentives for energy-efficient systems and increasing consumer awareness of climate change. The demand for smart HVAC solutions is on the rise, particularly in urban areas, as businesses seek to reduce operational costs and carbon footprints. Regulatory frameworks, such as the Energy Act 2013, support this transition by mandating energy efficiency improvements.

France : Focus on Energy Efficiency and Innovation

France's HVAC software market is valued at 70.0, driven by a strong emphasis on energy efficiency and sustainability. The government has implemented various initiatives, such as the Energy Transition for Green Growth Act, to promote the adoption of energy-efficient technologies. Demand trends indicate a shift towards smart HVAC systems, particularly in metropolitan areas like Paris and Lyon, where urbanization is accelerating. The competitive landscape features major players like Daikin and Carrier, who are investing in innovative solutions.

Russia : Growth Driven by Urbanization Trends

Russia's HVAC software market is valued at 50.0, with growth driven by rapid urbanization and infrastructure development. Key cities like Moscow and St. Petersburg are witnessing increased demand for advanced HVAC solutions as new commercial and residential projects emerge. Government initiatives aimed at modernizing infrastructure and improving energy efficiency are also contributing to market growth. The competitive landscape includes major players like Mitsubishi Electric and Honeywell, who are expanding their presence in the region.

Italy : Innovation and Sustainability Drive Demand

Italy's HVAC software market is valued at 45.0, with a focus on innovation and sustainability. The government has introduced various incentives to promote energy-efficient HVAC systems, aligning with EU directives on energy performance. Demand is particularly strong in cities like Milan and Rome, where there is a push for smart building technologies. The competitive landscape features key players such as Trane Technologies and Johnson Controls, who are adapting to local market needs and regulatory requirements.

Spain : Sustainable Solutions Gaining Traction

Spain's HVAC software market is valued at 40.0, with a growing emphasis on sustainable solutions. The government has implemented policies to encourage energy efficiency, such as the National Energy Efficiency Action Plan. Demand for HVAC systems is increasing in urban areas like Madrid and Barcelona, driven by new construction and renovation projects. Major players like Lennox International and Rheem are actively participating in this market, focusing on innovative and energy-efficient products.

Rest of Europe : Varied Demand Across Sub-Regions

The Rest of Europe HVAC software market is valued at 30.87, characterized by diverse demand across various countries. Growth drivers include regional regulations promoting energy efficiency and the increasing adoption of smart technologies. Countries like the Netherlands and Sweden are leading in sustainable HVAC solutions, while Eastern European nations are catching up. The competitive landscape features both local and international players, adapting to the unique market dynamics of each country.