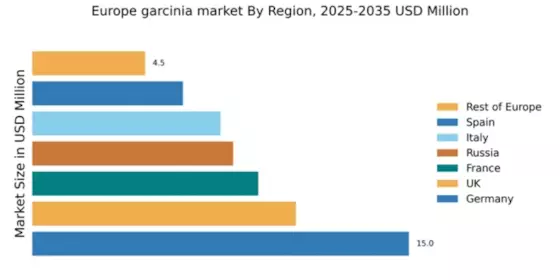

Germany : Strong Demand and Regulatory Support

Germany holds a significant 15.0% market share in the European garcinia market, valued at approximately €150 million. Key growth drivers include rising health consciousness, increasing obesity rates, and a growing preference for natural supplements. Regulatory support from the Federal Office of Consumer Protection and Food Safety ensures product safety and quality, fostering consumer trust. Additionally, advancements in logistics and distribution networks enhance product availability across the country.

UK : Health Trends Drive Garcinia Demand

The UK garners a 10.5% market share in the garcinia sector, translating to around €105 million. The increasing trend towards weight management and natural health products drives demand. The UK government promotes healthy lifestyles through various initiatives, which positively impacts the market. The rise of e-commerce platforms also facilitates access to garcinia products, catering to a tech-savvy consumer base.

France : Natural Supplements Gaining Popularity

France accounts for 9.0% of the European garcinia market, valued at approximately €90 million. The growth is fueled by a shift towards organic and natural products, with consumers increasingly seeking alternatives to synthetic supplements. Regulatory bodies like the French Agency for Food, Environmental and Occupational Health & Safety ensure compliance with health standards, enhancing consumer confidence. The market is also supported by a strong retail presence in urban areas.

Russia : Diverse Consumer Preferences Shape Demand

Russia holds an 8.0% market share in the garcinia market, valued at about €80 million. The growth is driven by a rising middle class and increasing awareness of health benefits associated with garcinia. However, regulatory complexities and varying consumer preferences pose challenges. The market is characterized by a mix of local and international brands, with major cities like Moscow and St. Petersburg being key consumption hubs.

Italy : Garcinia Popular Among Wellness Seekers

Italy represents 7.5% of the European garcinia market, valued at approximately €75 million. The increasing focus on wellness and preventive health measures drives demand for natural supplements. Government initiatives promoting healthy eating habits further support market growth. The competitive landscape includes both local and international players, with cities like Milan and Rome leading in consumption.

Spain : Health Awareness Fuels Market Growth

Spain captures a 6.0% market share in the garcinia market, valued at around €60 million. The rise in health awareness and lifestyle changes among consumers are key growth drivers. Regulatory frameworks are evolving to accommodate the growing supplement market, ensuring product safety. Major cities like Madrid and Barcelona are pivotal markets, with a mix of local and international brands competing for consumer attention.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe accounts for a 4.49% market share in the garcinia market, valued at approximately €44.9 million. This sub-region showcases diverse consumer preferences and varying levels of market maturity. Regulatory environments differ significantly, impacting product availability and consumer trust. Countries like Sweden and the Netherlands are emerging markets, with local players gaining traction alongside established international brands.