Rising Demand for High-Performance Gaming

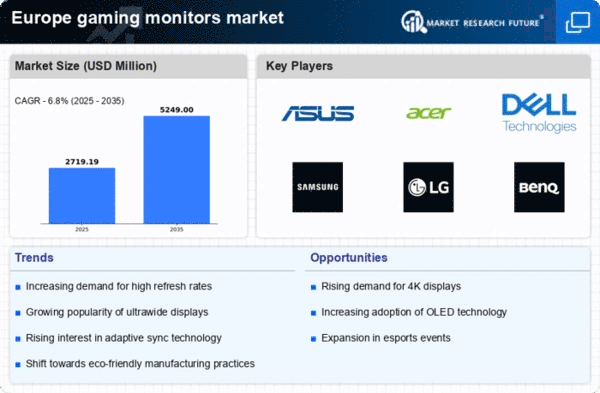

The gaming monitors market in Europe experiences a notable surge in demand for high-performance displays. Gamers increasingly seek monitors that offer superior refresh rates and response times, which are critical for competitive gaming. This trend is reflected in the market data, indicating that sales of monitors with refresh rates exceeding 144 Hz have grown by approximately 30% in the last year. As gaming becomes more mainstream, the expectation for enhanced visual experiences drives consumers to invest in advanced technology. The gaming monitors market is thus witnessing a shift towards premium products that cater to the needs of serious gamers, who prioritize performance and quality in their gaming setups.

Expansion of E-Sports and Competitive Gaming

The rise of e-sports in Europe significantly influences the gaming monitors market. With major tournaments and leagues gaining traction, there is an increasing need for specialized equipment that meets the demands of professional gamers. The gaming monitors market benefits from this trend, as players require monitors that provide exceptional clarity and rapid response times. Market analysis suggests that the e-sports sector is projected to grow by over 20% annually, further driving the demand for high-end gaming monitors. This growth not only enhances the visibility of gaming monitors but also encourages manufacturers to innovate and develop products tailored for competitive environments.

Growing Popularity of 4K and Ultra-Wide Monitors

The shift towards 4K and ultra-wide monitors is reshaping the gaming monitors market in Europe. Gamers are increasingly drawn to higher resolutions and wider aspect ratios, which provide immersive experiences and enhance gameplay. The gaming monitors market is witnessing a significant uptick in sales of 4K monitors, with a growth rate of approximately 25% over the past year. This trend is fueled by the availability of more powerful gaming consoles and PCs capable of supporting such resolutions. As consumers become more discerning about their gaming setups, the demand for ultra-wide monitors that offer expansive views is also on the rise, indicating a shift in consumer preferences.

Technological Advancements in Display Technology

Technological advancements play a pivotal role in shaping the gaming monitors market in Europe. Innovations such as OLED and Mini-LED technologies are becoming increasingly prevalent, offering gamers enhanced color accuracy and contrast ratios. The gaming monitors market is adapting to these advancements, with a reported increase in the adoption of OLED monitors, which are expected to capture around 15% of the market share by 2026. These developments not only improve the gaming experience but also attract a broader audience, including casual gamers who seek high-quality visuals. As technology continues to evolve, manufacturers are likely to invest in research and development to stay competitive.

Increased Focus on Gaming Communities and Content Creation

The gaming monitors market in Europe is also influenced by the growing focus on gaming communities and content creation. As more gamers engage in streaming and content production, there is a heightened demand for monitors that facilitate these activities. The gaming monitors market is adapting to this trend by offering features such as high refresh rates, low input lag, and advanced connectivity options. Market data suggests that the segment of monitors designed for content creators is expanding rapidly, with an estimated growth rate of 18% expected in the next two years. This shift not only caters to the needs of gamers but also supports the burgeoning ecosystem of online content creation.