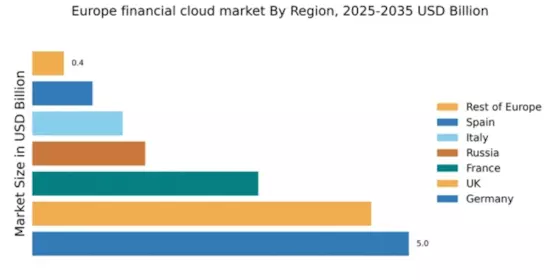

Germany : Strong Infrastructure and Innovation Hub

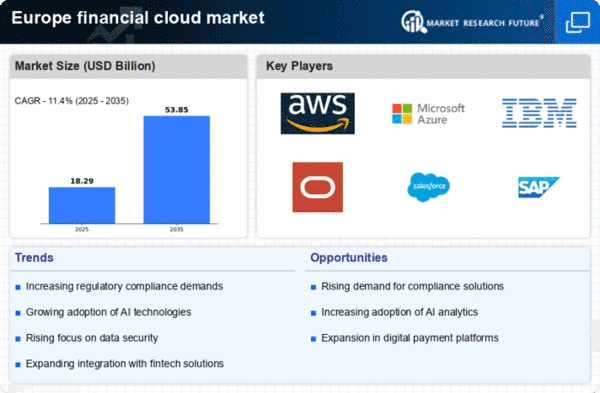

Key markets include major cities like Frankfurt, Berlin, and Munich, which are home to numerous financial institutions and tech startups. The competitive landscape features significant players like SAP, AWS, and Microsoft Azure, all vying for market share. The local business environment is characterized by a strong emphasis on innovation and collaboration, particularly in fintech and banking sectors, where cloud solutions are increasingly being adopted for operational efficiency and customer engagement.

UK : Fintech Innovation and Regulatory Support

Key markets include London, Manchester, and Edinburgh, which are hubs for financial services and technology. The competitive landscape is dominated by major players like AWS, Microsoft Azure, and IBM, alongside emerging fintech companies. The local market dynamics favor innovation, with a strong focus on compliance and security, particularly in banking and insurance sectors, where cloud solutions are being leveraged for enhanced customer experiences.

France : Regulatory Framework and Market Demand

Key markets include Paris, Lyon, and Marseille, which are central to the financial services industry. The competitive landscape features major players like IBM, Oracle, and local firms such as Atos. The business environment is characterized by a focus on innovation and compliance, particularly in the banking and insurance sectors, where cloud solutions are increasingly utilized for operational efficiency and regulatory adherence.

Russia : Regulatory Hurdles and Growth Opportunities

Key markets include Moscow and St. Petersburg, which are central to the financial services landscape. The competitive landscape features both local and international players, including SAP and Microsoft Azure. The local market dynamics are influenced by a mix of innovation and regulatory compliance, particularly in banking and finance, where cloud solutions are being explored for enhanced operational capabilities.

Italy : Digital Transformation in Financial Services

Key markets include Milan, Rome, and Turin, which are significant financial centers. The competitive landscape features major players like IBM, Oracle, and local firms. The local business environment is characterized by a growing emphasis on innovation and compliance, particularly in the banking sector, where cloud solutions are increasingly being adopted for improved service delivery.

Spain : Potential for Growth and Innovation

Key markets include Madrid and Barcelona, which are central to the financial services industry. The competitive landscape features both local and international players, including AWS and Microsoft Azure. The local market dynamics are characterized by a focus on innovation and compliance, particularly in banking and insurance sectors, where cloud solutions are being explored for operational efficiency.

Rest of Europe : Varied Adoption Across Countries

Key markets include countries like Belgium, Netherlands, and Switzerland, each with unique market characteristics. The competitive landscape features a mix of local and international players, including SAP and Google Cloud. The local business environment varies significantly, with some regions focusing on innovation and others facing regulatory challenges, particularly in banking and finance sectors.