Regulatory Compliance Pressure

The financial cloud market is experiencing heightened pressure from regulatory bodies to ensure compliance with various financial regulations. Institutions are increasingly required to adopt cloud solutions that not only enhance operational efficiency but also meet stringent compliance standards. This trend is particularly evident in the US, where regulatory frameworks such as the Dodd-Frank Act and the Gramm-Leach-Bliley Act impose strict guidelines on data management and security. As a result, financial institutions are investing in cloud technologies that facilitate compliance, thereby driving growth in the financial cloud market. The market is projected to reach $ 50 billion by 2026, indicating a robust demand for compliant cloud solutions.

Cost Efficiency and Scalability

Cost efficiency remains a pivotal driver in the financial cloud market, as organizations seek to optimize their operational expenditures. By migrating to cloud-based solutions, financial institutions can significantly reduce their IT infrastructure costs, which traditionally involve substantial capital investments. The scalability offered by cloud services allows firms to adjust their resources based on demand, thus avoiding over-provisioning and underutilization. In the US, it is estimated that financial institutions can save up to 30% on IT costs by leveraging cloud technologies. This financial incentive is likely to propel further adoption of cloud solutions, reinforcing the growth trajectory of the financial cloud market.

Enhanced Data Analytics Capabilities

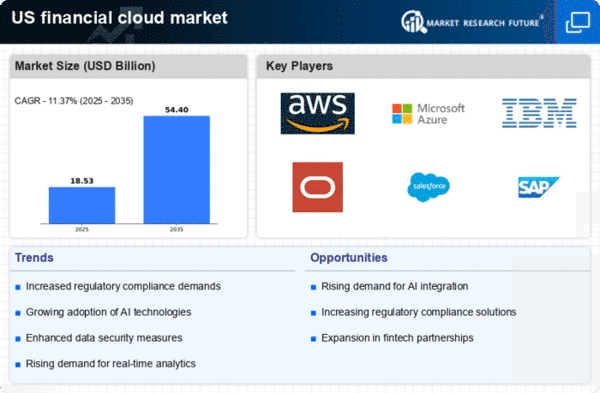

The financial cloud market is increasingly driven by the demand for advanced data analytics capabilities. Financial institutions are recognizing the value of harnessing big data to gain insights into customer behavior, risk management, and market trends. Cloud platforms provide the necessary infrastructure to process and analyze vast amounts of data efficiently. In the US, the integration of artificial intelligence and machine learning within cloud solutions is enabling firms to enhance their analytical capabilities. This trend is expected to contribute to a projected growth rate of 20% in the financial cloud market over the next five years, as organizations seek to leverage data for strategic decision-making.

Increased Focus on Customer Experience

In the financial cloud market, there is a growing emphasis on enhancing customer experience through innovative cloud solutions. Financial institutions are leveraging cloud technologies to offer personalized services, streamline operations, and improve customer engagement. The ability to access services anytime and anywhere is becoming a critical factor for customer satisfaction. In the US, financial firms that adopt cloud solutions report a 25% increase in customer retention rates. This focus on customer-centricity is likely to drive further investments in cloud technologies, thereby propelling the financial cloud market forward.

Collaboration with Technology Providers

The financial cloud market is witnessing a surge in collaborations. These collaborations are between financial institutions and technology providers. These partnerships are aimed at developing tailored cloud solutions that address specific industry needs. By collaborating with fintech companies and cloud service providers, financial institutions can leverage innovative technologies to enhance their service offerings. In the US, such collaborations are expected to increase by 40% over the next few years, as firms seek to stay competitive in a rapidly evolving market. This trend is likely to foster innovation and drive growth within the financial cloud market.