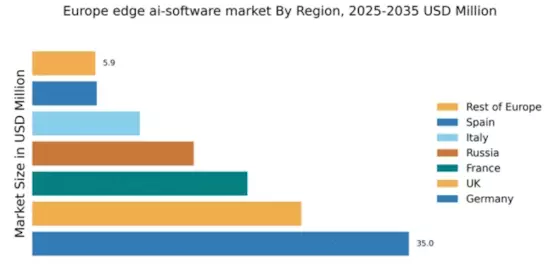

Germany : Innovation Hub Driving Growth

Germany holds a commanding 35.0% market share in the edge AI software sector, valued at approximately €1.4 billion. Key growth drivers include robust industrial automation, significant investments in R&D, and a strong push towards digital transformation across sectors. The government has implemented favorable regulatory policies, including the Digital Strategy 2025, which aims to enhance infrastructure and promote AI adoption in various industries.

UK : Strong Demand and Innovation

The UK commands a 25.0% market share in the edge AI software market, valued at around €1 billion. Growth is driven by increasing demand for AI in sectors like finance, healthcare, and manufacturing. The UK government has launched initiatives such as the AI Sector Deal, promoting investment in AI technologies. The competitive landscape is vibrant, with London and Manchester emerging as key hubs for AI innovation and development.

France : Government Support Fuels Growth

France holds a 20.0% market share in the edge AI software market, valued at approximately €800 million. The growth is propelled by government initiatives like the AI for Humanity strategy, which aims to position France as a leader in AI. Demand is rising in sectors such as automotive and healthcare, with a focus on smart city applications. Paris and Lyon are key markets, hosting numerous startups and established players.

Russia : Investment in Technology and Innovation

Russia captures a 15.0% market share in the edge AI software market, valued at about €600 million. Key growth drivers include increased government investment in technology and a burgeoning startup ecosystem. The Russian government has introduced the National Strategy for AI Development, aiming to enhance AI capabilities across various sectors. Moscow and St. Petersburg are pivotal markets, with a focus on defense and energy applications.

Italy : Manufacturing Sector Leading Growth

Italy accounts for a 10.0% market share in the edge AI software market, valued at approximately €400 million. The growth is primarily driven by the manufacturing sector's push for automation and efficiency. The Italian government has launched initiatives to support digital transformation, including the National Plan for Industry 4.0. Key markets include Milan and Turin, where major players are investing in AI solutions for manufacturing.

Spain : Focus on Smart Solutions

Spain holds a 6.0% market share in the edge AI software market, valued at around €240 million. Growth is driven by increasing demand for smart solutions in sectors like tourism and agriculture. The Spanish government has introduced the AI Strategy 2020, promoting AI adoption across industries. Barcelona and Madrid are key markets, with a growing number of startups focusing on AI applications in various sectors.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe accounts for a 5.86% market share in the edge AI software market, valued at approximately €230 million. Growth is driven by diverse regional demands and varying levels of government support for AI initiatives. Countries like Sweden and the Netherlands are emerging as key players, with strong investments in AI research and development. The competitive landscape is fragmented, with numerous local startups and established firms.