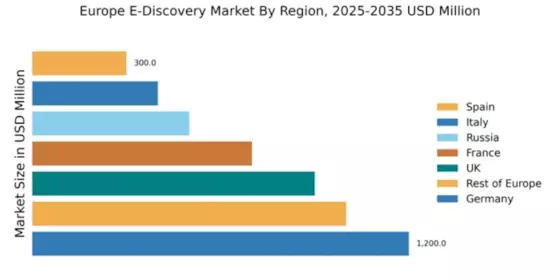

Germany : Robust Growth Driven by Innovation

Germany holds a commanding 30% market share in the European e-discovery sector, valued at $1,200.0 million. Key growth drivers include a strong legal framework, increasing data privacy regulations, and a rising demand for digital evidence in litigation. The German government has initiated several digitalization programs, enhancing infrastructure and promoting technological advancements in legal tech. The trend towards remote work has also accelerated the adoption of e-discovery solutions, as organizations seek efficient data management tools.

UK : Innovation Meets Regulatory Compliance

The UK e-discovery market accounts for 22.5% of the European share, valued at $900.0 million. Growth is driven by stringent data protection laws like GDPR, which necessitate robust e-discovery solutions. The demand for cloud-based services is rising, as organizations seek scalable and secure options. The UK government supports digital initiatives, enhancing the legal tech ecosystem and encouraging investment in innovative solutions.

France : Legal Reforms Fueling Market Expansion

France represents 17.5% of the European e-discovery market, valued at $700.0 million. The growth is propelled by recent legal reforms aimed at modernizing the judicial process, which have increased the need for efficient e-discovery tools. The French government is actively promoting digital transformation in the legal sector, leading to higher adoption rates of technology. Additionally, the rise of data-driven litigation is influencing consumption patterns.

Russia : Regulatory Changes Driving Demand

Russia holds a 12.5% share of the European e-discovery market, valued at $500.0 million. The market is experiencing growth due to recent regulatory changes that emphasize data protection and compliance. Increased investment in technology infrastructure is also a key driver, as businesses seek to enhance their legal capabilities. The demand for e-discovery solutions is particularly strong in major cities like Moscow and St. Petersburg, where legal tech adoption is on the rise.

Italy : Legal Sector Embracing Technology

Italy accounts for 10% of the European e-discovery market, valued at $400.0 million. The growth is fueled by a shift towards digitalization in the legal sector, driven by government initiatives promoting technology adoption. The demand for e-discovery solutions is increasing as Italian businesses face more complex legal challenges. Key cities like Milan and Rome are becoming hubs for legal tech innovation, attracting major players in the market.

Spain : Growing Demand in Legal Sector

Spain represents 7.5% of the European e-discovery market, valued at $300.0 million. The market is growing due to an increasing focus on compliance and data protection regulations. Spanish businesses are increasingly adopting e-discovery solutions to manage legal risks effectively. The government is also promoting digital transformation initiatives, which are enhancing the legal tech landscape. Major cities like Madrid and Barcelona are key markets for e-discovery services.

Rest of Europe : Varied Growth Across Regions

The Rest of Europe accounts for 25% of the e-discovery market, valued at $1,000.0 million. This segment includes a mix of mature and emerging markets, each with unique growth drivers. Factors such as varying regulatory environments and levels of technological adoption influence demand. Countries like the Netherlands and Belgium are seeing increased investment in legal tech, while others are catching up. The competitive landscape is diverse, with both local and international players vying for market share.