Increased Investment in Biotechnology

The surge in investment within the biotechnology sector is propelling the Artificial Intelligence (AI) in Drug Discovery Market forward. Venture capital funding and government grants are increasingly directed towards AI-driven biotech firms, facilitating the development of innovative drug discovery solutions. In 2023, investments in AI-focused biotech companies reached approximately USD 1.2 billion, underscoring the growing confidence in AI's potential to revolutionize drug development. This influx of capital not only accelerates research and development but also fosters collaboration between tech companies and pharmaceutical firms, enhancing the overall landscape of drug discovery.

Regulatory Support for AI Integration

Regulatory bodies are increasingly recognizing the potential of AI in drug discovery, providing support that drives the Artificial Intelligence (AI) in Drug Discovery Market. Initiatives aimed at establishing guidelines for the use of AI in clinical trials and drug approval processes are emerging. This regulatory support not only enhances the credibility of AI-driven solutions but also encourages pharmaceutical companies to adopt these technologies. As regulations evolve to accommodate AI innovations, the market is expected to benefit from increased trust and acceptance, facilitating the integration of AI into mainstream drug discovery practices.

Rising Demand for Personalized Medicine

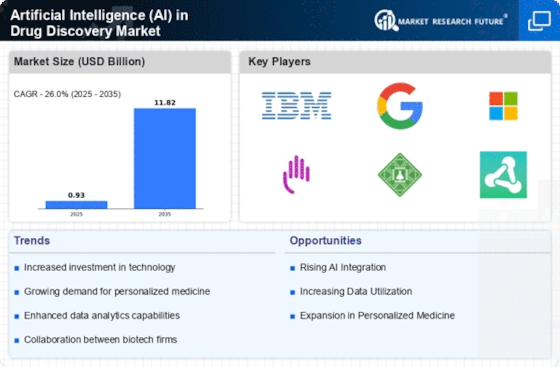

The increasing emphasis on personalized medicine is a key driver in the Artificial Intelligence (AI) in Drug Discovery Market. As healthcare shifts towards tailored treatments, AI technologies are being leveraged to analyze vast datasets, including genetic information, to identify potential drug candidates that are more effective for specific patient populations. This trend is reflected in the projected growth of the market, which is expected to reach USD 3.5 billion by 2026. The ability of AI to predict patient responses to drugs enhances the efficiency of drug development processes, thereby reducing time and costs associated with bringing new therapies to market.

Advancements in Machine Learning Algorithms

Recent advancements in machine learning algorithms are significantly influencing the Artificial Intelligence (AI) in Drug Discovery Market. These algorithms enable researchers to process and analyze complex biological data more efficiently, leading to the identification of novel drug candidates. For instance, deep learning techniques have shown promise in predicting molecular interactions and optimizing drug design. The market is anticipated to grow at a compound annual growth rate (CAGR) of 40% from 2023 to 2030, driven by these technological innovations. As machine learning continues to evolve, its applications in drug discovery are likely to expand, further enhancing the industry's capabilities.

Growing Need for Cost-Effective Drug Development

The pressing need for cost-effective drug development is a significant driver in the Artificial Intelligence (AI) in Drug Discovery Market. Traditional drug discovery processes are often lengthy and expensive, with high failure rates. AI technologies offer solutions to streamline these processes, potentially reducing costs by up to 30%. By utilizing predictive analytics and simulations, AI can identify promising drug candidates earlier in the development pipeline, thereby minimizing resource expenditure. As pharmaceutical companies seek to optimize their R&D budgets, the adoption of AI in drug discovery is likely to increase, further driving market growth.