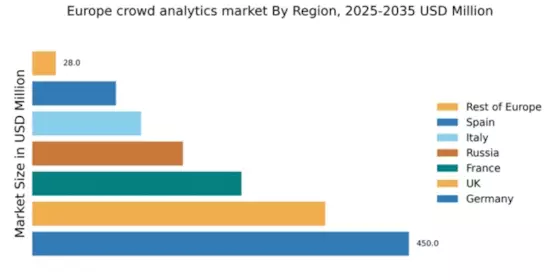

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the European crowd analytics market, accounting for 450.0 million, representing approximately 40% of the total market share. Key growth drivers include a robust industrial base, increasing urbanization, and a strong emphasis on data-driven decision-making. Government initiatives promoting smart city projects and digital transformation are also pivotal. The country’s advanced infrastructure supports the integration of crowd analytics into various sectors, enhancing operational efficiency and customer engagement.

UK : Innovation and Technology Leadership

Key markets include London, Manchester, and Birmingham, where major players like IBM and Microsoft have established a strong presence. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering a vibrant business environment. Local dynamics emphasize the integration of crowd analytics in public safety, event management, and urban planning, driving sector-specific applications.

France : Investment in Smart Technologies

Key cities like Paris, Lyon, and Marseille are pivotal markets, with significant contributions from local tech firms and international players like Oracle and SAP. The competitive landscape is marked by collaboration between public and private sectors, enhancing the business environment. Applications in urban mobility, public safety, and retail analytics are gaining traction, reflecting the diverse use cases of crowd analytics.

Russia : Focus on Urban Development

Key markets include Moscow and St. Petersburg, where major players like SAP and local firms are actively competing. The competitive landscape is evolving, with a mix of established companies and emerging startups. Local dynamics emphasize the integration of crowd analytics in urban planning and public safety, creating opportunities for sector-specific applications and innovations.

Italy : Focus on Retail and Tourism Sectors

Key markets include Milan, Rome, and Florence, where major players like IBM and Google are establishing a presence. The competitive landscape features a blend of international firms and local startups, fostering innovation. Local dynamics highlight the application of crowd analytics in enhancing customer experiences in retail and optimizing tourism management, reflecting the sector-specific focus of the market.

Spain : Focus on Urban Mobility Solutions

Key markets include Madrid and Barcelona, where major players like Cisco Systems and TIBCO Software are making significant inroads. The competitive landscape is characterized by a mix of established firms and innovative local companies. Local dynamics emphasize the application of crowd analytics in urban planning and transportation management, reflecting the growing focus on smart city solutions.

Rest of Europe : Diverse Applications Across Regions

Key markets include smaller cities and regions where local firms are leveraging crowd analytics for specific applications. The competitive landscape is less concentrated, with opportunities for local players to innovate. Local dynamics emphasize the integration of crowd analytics in healthcare management and community planning, reflecting the unique needs of these markets.