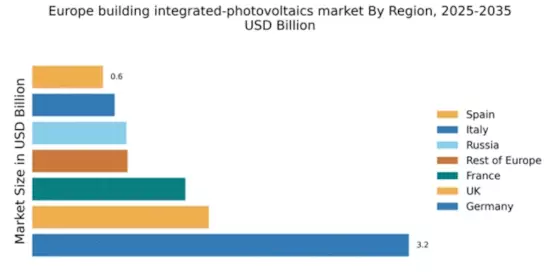

Germany : Strong market share and innovation

Germany holds a commanding 3.2% market share in the integrated photovoltaics (BIPV) sector, driven by robust government incentives and a strong focus on renewable energy. The demand for BIPV solutions is fueled by increasing energy costs and a growing emphasis on sustainable building practices. Regulatory frameworks, such as the Renewable Energy Sources Act (EEG), promote solar energy adoption, while advancements in technology enhance efficiency and integration into building designs. Infrastructure investments further support this growth.

UK : Government support and innovation

The UK holds a 1.5% market share in the BIPV sector, with significant growth potential driven by government initiatives like the Feed-in Tariff and Renewable Heat Incentive. Demand is rising as businesses and homeowners seek sustainable energy solutions, particularly in urban areas. The UK government’s commitment to net-zero emissions by 2050 is a key driver, alongside increasing awareness of energy efficiency and sustainability in construction practices. Infrastructure upgrades are also enhancing market viability.

France : Regulatory support boosts BIPV adoption

France's BIPV market accounts for 1.3%, supported by strong regulatory frameworks such as the Energy Transition Law. The demand for integrated photovoltaics is growing, particularly in urban centers like Paris and Lyon, where energy efficiency is prioritized. Government incentives and subsidies encourage the adoption of BIPV technologies, aligning with France's commitment to reducing carbon emissions. The construction sector is increasingly integrating solar solutions into new developments, enhancing market growth.

Russia : Potential for future growth

Russia's BIPV market is currently at 0.8%, with significant potential for growth as awareness of renewable energy increases. Key drivers include government initiatives aimed at diversifying energy sources and reducing reliance on fossil fuels. Urban areas like Moscow and St. Petersburg are beginning to adopt BIPV technologies, although the market is still developing. The competitive landscape is emerging, with local and international players exploring opportunities in this nascent sector.

Italy : Cultural shift towards sustainability

Italy's BIPV market stands at 0.7%, with a growing emphasis on sustainable architecture and energy efficiency. The Italian government supports BIPV through incentives and regulations that promote renewable energy use. Demand is particularly strong in cities like Milan and Rome, where architectural heritage meets modern energy solutions. The competitive landscape includes both local firms and international players, fostering innovation and collaboration in the sector.

Spain : Strong demand for energy solutions

Spain's BIPV market is valued at 0.6%, driven by high solar irradiance and increasing energy costs. Government policies, such as the National Integrated Energy and Climate Plan, support the adoption of renewable technologies. Key markets include Barcelona and Madrid, where urban development projects increasingly incorporate BIPV solutions. The competitive landscape features both domestic and international companies, enhancing innovation and market penetration in the sector.

Rest of Europe : Varied market dynamics across regions

The Rest of Europe accounts for a 0.81% market share in the BIPV sector, with diverse opportunities emerging across different countries. Regulatory frameworks vary, influencing market growth and adoption rates. Countries like the Netherlands and Sweden are seeing increased interest in BIPV technologies, driven by sustainability goals and energy efficiency mandates. The competitive landscape includes a mix of local and international players, fostering innovation and collaboration in the sector.