Rising Energy Costs

The increasing cost of traditional energy sources is a pivotal driver for the Building Integrated Photovoltaics Market. As energy prices continue to rise, consumers and businesses are seeking alternative solutions to mitigate expenses. Building integrated photovoltaics (BIPV) offer a dual benefit of energy generation and building material, which can lead to significant savings over time. Reports indicate that energy costs have surged by approximately 20% in recent years, prompting a shift towards renewable energy solutions. This trend is likely to accelerate the adoption of BIPV technologies, as they provide a sustainable and economically viable option for energy generation. Furthermore, the long-term financial benefits associated with BIPV installations, such as reduced utility bills and potential tax incentives, enhance their attractiveness in the current market landscape.

Environmental Awareness

Growing environmental consciousness among consumers and businesses is a crucial driver for the Building Integrated Photovoltaics Market. As awareness of climate change and environmental degradation increases, there is a heightened demand for sustainable building practices. BIPV systems not only contribute to energy generation but also reduce the carbon footprint of buildings. Studies suggest that buildings account for nearly 40% of global energy consumption, making the integration of renewable energy sources essential. The shift towards eco-friendly construction materials and practices is likely to propel the BIPV market forward, as stakeholders seek to align with sustainability goals. Additionally, the emphasis on reducing greenhouse gas emissions is expected to drive regulatory frameworks that favor the adoption of BIPV technologies, further solidifying their role in the construction industry.

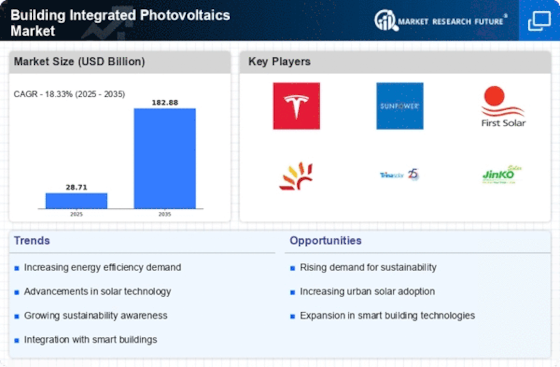

Technological Innovations

Technological advancements play a significant role in shaping the Building Integrated Photovoltaics Market. Innovations in solar cell efficiency, materials, and integration techniques have made BIPV systems more effective and aesthetically pleasing. Recent developments in thin-film solar technology and building materials have enhanced the performance and versatility of BIPV solutions. For instance, the efficiency of solar cells has improved, with some reaching over 25%, which is likely to increase the appeal of BIPV installations. Furthermore, the integration of smart technologies, such as energy management systems, allows for optimized energy usage in buildings. These innovations not only enhance the functionality of BIPV systems but also contribute to their growing acceptance in the construction sector, as builders and architects seek to incorporate cutting-edge solutions into their designs.

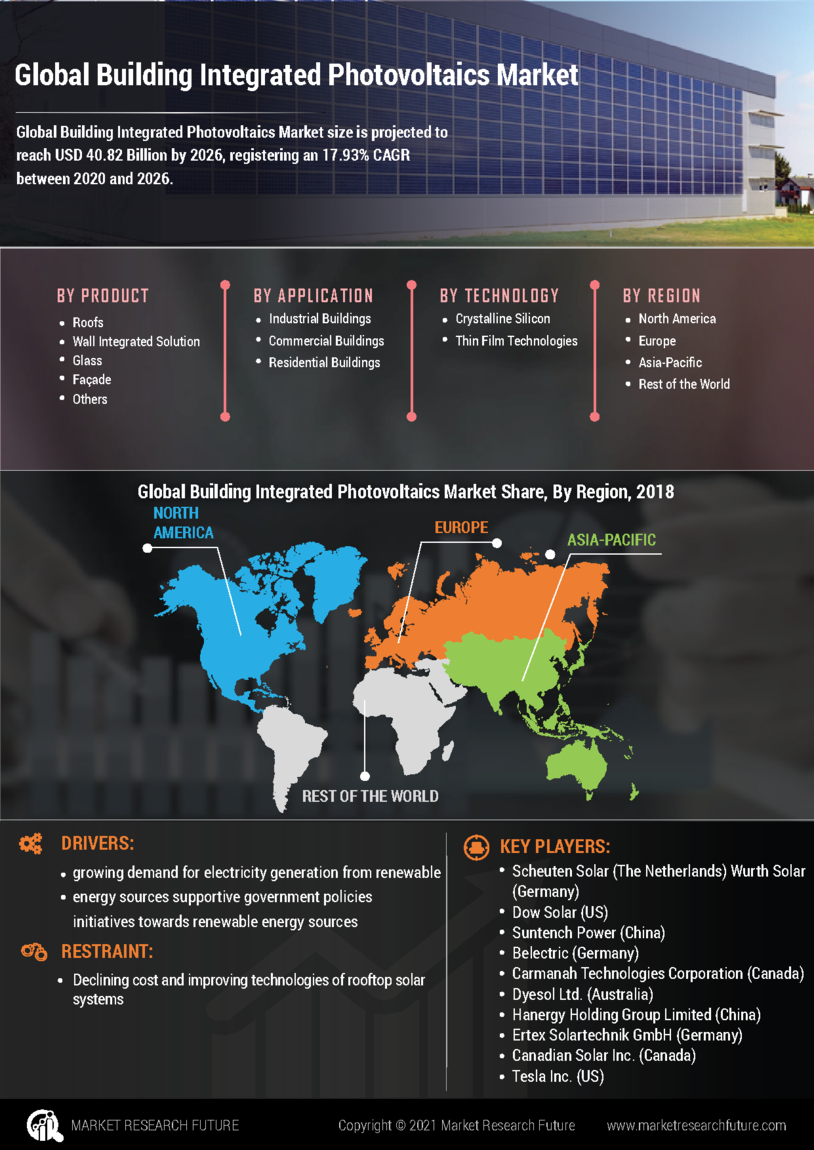

Government Policies and Incentives

Supportive government policies and incentives are instrumental in driving the Building Integrated Photovoltaics Market. Many governments are implementing regulations and financial incentives to promote renewable energy adoption, including tax credits, rebates, and grants for BIPV installations. These initiatives aim to reduce the initial investment costs associated with BIPV systems, making them more accessible to a broader audience. For example, certain regions have reported a 30% increase in BIPV installations due to favorable policy frameworks. Additionally, the commitment to achieving renewable energy targets and reducing carbon emissions is likely to result in further supportive measures. As governments continue to prioritize sustainability, the BIPV market is expected to benefit from enhanced funding and resources, facilitating its growth in the coming years.

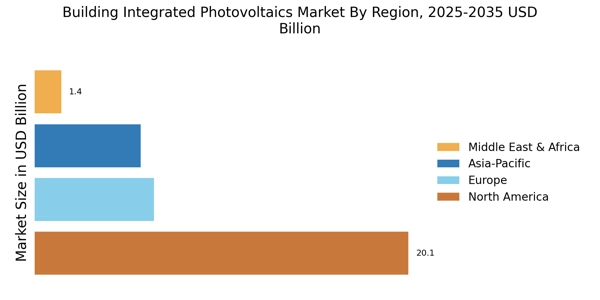

Urbanization and Infrastructure Development

The ongoing trend of urbanization and infrastructure development serves as a significant driver for the Building Integrated Photovoltaics Market. As urban areas expand, there is an increasing demand for energy-efficient buildings that can accommodate growing populations. BIPV systems offer a unique solution by integrating energy generation directly into building designs, thus optimizing space and resources. Reports indicate that urban areas are projected to house over 68% of the global population by 2050, necessitating innovative building solutions. The integration of BIPV technologies in new construction and retrofitting projects is likely to become a standard practice, as stakeholders seek to meet energy demands sustainably. Furthermore, the emphasis on smart city initiatives and sustainable urban planning is expected to further drive the adoption of BIPV systems, positioning them as a key component of future urban infrastructure.