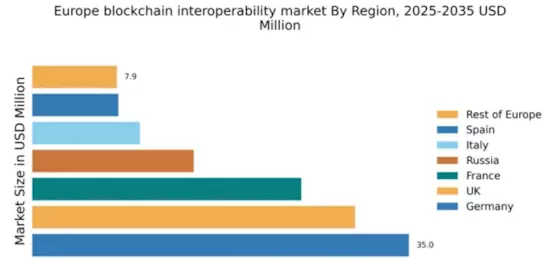

Germany : Strong Growth and Innovation Landscape

Germany holds a commanding 35.0% market share in the blockchain interoperability sector, valued at approximately €1.4 billion. Key growth drivers include a robust tech ecosystem, significant venture capital investment, and supportive government policies promoting digital innovation. Demand is surging in sectors like finance and logistics, driven by increasing adoption of decentralized applications. The German government has implemented favorable regulations, enhancing infrastructure and fostering industrial development in blockchain technology.

UK : Innovation and Investment at Forefront

The UK commands a 30.0% market share in the blockchain interoperability market, valued at around €1.2 billion. Growth is fueled by a vibrant startup culture, significant investments in fintech, and a strong focus on regulatory clarity. Demand is particularly high in sectors like finance and supply chain management, with increasing interest from enterprises seeking interoperability solutions. The UK government has introduced initiatives to support blockchain research and development, enhancing the overall business environment.

France : Government Support and Market Growth

France holds a 25.0% market share in the blockchain interoperability market, valued at approximately €1 billion. Key growth drivers include government-backed initiatives like the French Tech Visa and a growing number of blockchain startups. Demand is rising in sectors such as healthcare and logistics, with a focus on enhancing transparency and efficiency. The French government has established a regulatory framework that encourages innovation while ensuring consumer protection, contributing to a favorable market environment.

Russia : Regulatory Challenges and Opportunities

Russia accounts for a 15.0% market share in the blockchain interoperability sector, valued at around €600 million. Growth is driven by increasing interest from tech companies and government initiatives aimed at digital transformation. Demand is particularly strong in sectors like energy and finance, where blockchain can enhance operational efficiency. However, regulatory challenges persist, with the government working to establish clearer guidelines for blockchain technology and its applications.

Italy : Cultural Heritage Meets Technology

Italy holds a 10.0% market share in the blockchain interoperability market, valued at approximately €400 million. Growth is supported by a burgeoning startup ecosystem and increasing interest from traditional industries like fashion and art. Demand trends indicate a rising need for transparency and traceability in supply chains. The Italian government has initiated programs to promote blockchain adoption, particularly in public administration and cultural heritage sectors, enhancing the overall market landscape.

Spain : Focus on Innovation and Collaboration

Spain commands an 8.0% market share in the blockchain interoperability market, valued at around €320 million. Key growth drivers include a collaborative approach among startups, universities, and government entities. Demand is increasing in sectors like tourism and finance, where blockchain can streamline operations. The Spanish government has launched initiatives to foster innovation in blockchain technology, creating a supportive environment for market players and enhancing infrastructure development.

Rest of Europe : Varied Markets with Unique Challenges

The Rest of Europe holds a 7.87% market share in the blockchain interoperability sector, valued at approximately €315 million. Growth is driven by diverse market conditions across countries, with varying levels of regulatory support and technological adoption. Demand trends indicate a focus on sectors like agriculture and logistics, where blockchain can improve efficiency. Local market dynamics vary significantly, with some countries embracing blockchain more rapidly than others, creating a mixed competitive landscape.