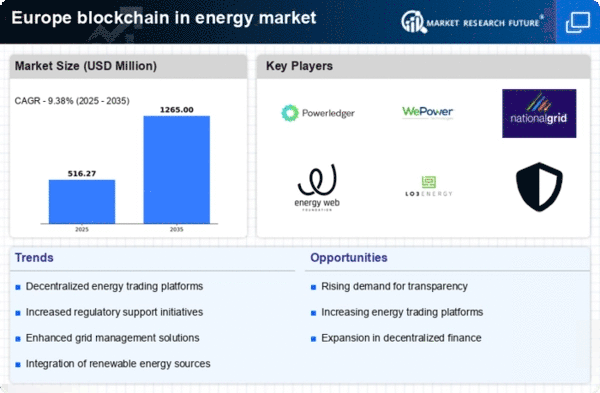

Consumer Demand for Energy Transparency

In the blockchain in-energy market, there is a growing consumer demand for transparency in energy consumption and pricing. European consumers are increasingly aware of their energy usage and are seeking more control over their energy choices. Blockchain technology offers a solution by providing immutable records of energy transactions, which can enhance trust between consumers and energy providers. This trend is reflected in a survey indicating that over 70% of consumers in Europe prefer energy suppliers that utilize blockchain for transparent billing and energy tracking. As this demand continues to rise, energy companies are likely to adopt blockchain solutions to meet consumer expectations and remain competitive.

Investment in Renewable Energy Projects

The blockchain in-energy market is significantly influenced by the increasing investment in renewable energy projects across Europe. As countries strive to meet ambitious climate goals, there is a notable shift towards sustainable energy sources. Blockchain technology plays a pivotal role in facilitating investments by enabling decentralized financing models and improving the traceability of renewable energy credits. In 2025, investments in renewable energy projects in Europe are projected to exceed €200 billion, with a substantial portion being allocated to blockchain-enabled initiatives. This trend not only supports the growth of the blockchain in-energy market but also aligns with the broader objectives of reducing carbon emissions and enhancing energy security.

Collaboration Among Industry Stakeholders

Collaboration among various stakeholders in the blockchain in-energy market is becoming increasingly vital. Energy producers, consumers, regulators, and technology providers are recognizing the need to work together to harness the full potential of blockchain technology. Initiatives such as public-private partnerships are emerging, aimed at developing pilot projects that demonstrate the efficacy of blockchain in energy trading and management. By November 2025, it is anticipated that collaborative efforts will lead to the establishment of at least 30 blockchain pilot projects across Europe, showcasing the collective commitment to innovation in the energy sector. This collaborative approach not only accelerates the adoption of blockchain solutions but also fosters a shared understanding of the technology's benefits and challenges.

Regulatory Support for Blockchain Adoption

The blockchain in-energy market in Europe is experiencing a surge in regulatory support aimed at fostering innovation and sustainability. Governments are increasingly recognizing the potential of blockchain technology to enhance transparency and efficiency in energy transactions. For instance, the European Union has introduced various initiatives to promote digitalization in the energy sector, which includes blockchain solutions. This regulatory backing is crucial as it not only encourages investment but also provides a framework for the safe and effective implementation of blockchain technologies. As of 2025, approximately 60% of European countries have established policies that facilitate the integration of blockchain in energy systems, indicating a strong commitment to modernizing the energy landscape.

Technological Advancements in Blockchain Solutions

Technological advancements are driving the evolution of the blockchain in-energy market in Europe. Innovations in blockchain protocols and smart contracts are enhancing the efficiency and scalability of energy transactions. These advancements allow for real-time data sharing and automated processes, which are essential for managing complex energy systems. As of November 2025, it is estimated that over 50% of energy companies in Europe are exploring or implementing advanced blockchain solutions to optimize their operations. This trend suggests that ongoing research and development in blockchain technology will continue to shape the future of energy management, making it more efficient and responsive to market demands.

Leave a Comment