Government Initiatives and Funding

Government initiatives aimed at promoting sustainable agricultural practices are significantly influencing the Europe Biostimulants Market. Various European nations have implemented policies that encourage the use of biostimulants as part of their agricultural strategies. For instance, the European Union's Common Agricultural Policy (CAP) provides financial support for farmers adopting environmentally friendly practices, including the use of biostimulants. This funding not only incentivizes farmers to explore biostimulant options but also fosters research and development in this sector. As a result, the market is expected to witness a surge in biostimulant adoption, with projections indicating a potential market value exceeding EUR 1 billion by 2027. Such government backing is crucial for the long-term growth and sustainability of the biostimulants market in Europe.

Increasing Awareness of Soil Health

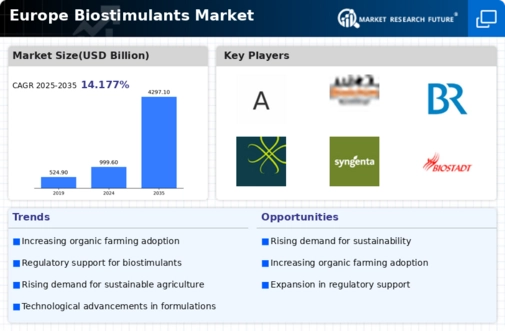

The growing recognition of soil health as a critical component of sustainable agriculture is driving the Europe Biostimulants Market. Farmers and agronomists are increasingly aware that healthy soil contributes to improved crop yields and resilience against pests and diseases. This awareness is reflected in the rising adoption of biostimulants, which enhance soil fertility and microbial activity. According to recent data, the European biostimulants market is projected to grow at a compound annual growth rate of approximately 12% over the next five years, indicating a robust shift towards practices that prioritize soil health. As stakeholders in the agricultural sector continue to emphasize the importance of soil quality, the demand for biostimulants is likely to increase, further propelling the market forward.

Rising Agricultural Production Costs

The escalating costs associated with traditional agricultural inputs are driving farmers in Europe to seek alternative solutions, thereby benefiting the Europe Biostimulants Market. As the prices of synthetic fertilizers and pesticides continue to rise, many farmers are exploring biostimulants as a cost-effective alternative that can enhance crop productivity without incurring high expenses. Biostimulants not only improve nutrient uptake but also promote plant health, potentially leading to reduced reliance on more expensive chemical inputs. Market data suggests that the biostimulants sector could capture a larger share of the agricultural input market, with estimates indicating a growth trajectory that could see biostimulants account for 20% of the total agricultural input market by 2030. This trend underscores the potential for biostimulants to play a crucial role in addressing the economic challenges faced by farmers.

Technological Advancements in Agriculture

Technological advancements in agriculture are playing a pivotal role in shaping the Europe Biostimulants Market. Innovations in biostimulant formulations, such as the development of microbial and natural extracts, are enhancing the efficacy and application of these products. Furthermore, precision agriculture technologies are enabling farmers to apply biostimulants more effectively, optimizing their benefits. The integration of data analytics and IoT in farming practices allows for tailored biostimulant applications based on specific crop needs and soil conditions. As these technologies become more accessible, the adoption of biostimulants is expected to rise, with market analysts projecting a growth rate of around 10% annually in the coming years. This technological evolution is likely to create new opportunities within the biostimulants market, fostering innovation and efficiency.

Consumer Preference for Sustainable Products

The increasing consumer preference for sustainably produced food is a significant driver of the Europe Biostimulants Market. As consumers become more environmentally conscious, they are demanding products that are not only organic but also produced using sustainable agricultural practices. Biostimulants, which enhance crop growth without the adverse effects associated with synthetic fertilizers, align well with these consumer preferences. Market Research Future indicates that over 60% of European consumers are willing to pay a premium for sustainably sourced products. This shift in consumer behavior is prompting farmers to adopt biostimulants to meet market demands, thereby driving growth in the biostimulants sector. The alignment of consumer preferences with sustainable agricultural practices is likely to continue influencing the market dynamics in Europe.