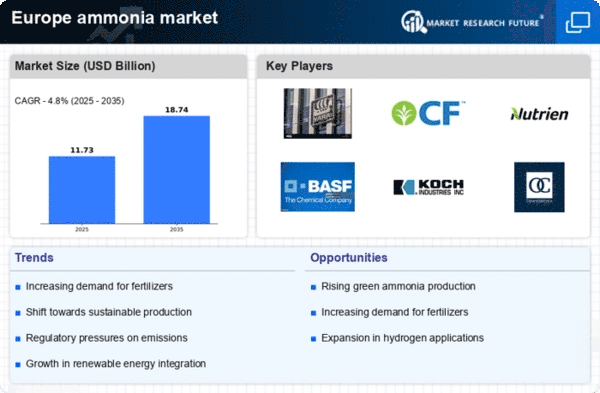

Rising Demand for Fertilizers

The ammonia market in Europe experiences a notable surge in demand for fertilizers, driven by the agricultural sector's need for enhanced crop yields. As the population grows, the necessity for food production increases, leading to a projected growth rate of approximately 3.5% annually in fertilizer consumption. This trend is particularly evident in Eastern Europe, where agricultural modernization efforts are underway. The ammonia market is poised to benefit from this rising demand, as ammonia serves as a key ingredient in nitrogen-based fertilizers. Furthermore, the European Union's commitment to sustainable agriculture practices may further bolster the market, as farmers seek efficient solutions to meet both productivity and environmental standards.

Investment in Renewable Energy Sources

The ammonia market in Europe is increasingly intertwined with the renewable energy sector. Investments in renewable energy sources, such as wind and solar, are expected to facilitate the production of green ammonia, which is derived from renewable hydrogen. This shift is projected to create a market opportunity valued at approximately €10 billion by 2030. The ammonia market stands to gain from this transition, as the demand for sustainable energy solutions grows. Additionally, the integration of renewable energy into ammonia production processes may lead to reduced operational costs and enhanced competitiveness in the global market.

Growing Industrial Applications of Ammonia

The ammonia market in Europe is experiencing a diversification of applications beyond traditional fertilizers. Industries such as pharmaceuticals, textiles, and refrigeration are increasingly utilizing ammonia for various processes. This trend indicates a potential market expansion, with estimates suggesting a growth rate of around 4% annually in industrial ammonia consumption. The ammonia market is likely to capitalize on this trend, as the versatility of ammonia makes it a valuable component in multiple sectors. As industries seek cost-effective and efficient solutions, the demand for ammonia in non-agricultural applications is expected to rise, further solidifying its position in the European market.

Regulatory Support for Sustainable Practices

The ammonia market in Europe is significantly influenced by regulatory frameworks aimed at promoting sustainable practices. The European Green Deal, which aims to make Europe climate-neutral by 2050, encourages the adoption of cleaner production methods. This regulatory environment fosters innovation within the ammonia market, as companies are incentivized to invest in technologies that reduce carbon emissions. For instance, the EU's Carbon Border Adjustment Mechanism may impact pricing strategies, potentially increasing the competitiveness of low-emission ammonia production. As a result, the industry is likely to see a shift towards greener production methods, aligning with both regulatory requirements and market expectations.

Technological Advancements in Ammonia Synthesis

The ammonia market in Europe is witnessing rapid technological advancements that enhance the efficiency of ammonia synthesis processes. Innovations such as the Haber-Bosch process optimization and the development of electrochemical synthesis methods are transforming production capabilities. These advancements could potentially reduce energy consumption by up to 30%, thereby lowering production costs. The ammonia market is likely to benefit from these improvements, as they not only increase output but also align with the growing demand for sustainable production methods. As companies adopt these technologies, the competitive landscape may shift, favoring those who can leverage these innovations effectively.